Distributors learned some difficult lessons through the pandemic, and they’re planning to build resilience by investing further in digital capabilities, accommodating remote work where feasible, and more.

This post previews some of the key findings in the third report of the research series, Adding Value in a Post-Pandemic World: New Leadership Strategies for Distributors, produced in conjunction with the National Association of Wholesaler-Distributors (NAW). “Pandemic Effects on Distributors,” explored new leadership strategies distributors learned over the last 18 months and how they can apply them in the future. Click here to download the full report.

While the business world is normalizing in many ways, the nature of work will never really be the same. Employees, suppliers and customers will increasingly rely on digital tools to collaborate and transact. And executives have learned that managing customer relationships is not just about making in-person sales calls; it involves blending in phone and video contacts, too.

Still, distributors reported very positive sentiments for the upcoming 24 months in our survey with the National Association of Wholesaler-Distributors, though this optimism seems to come with a few caveats. Respondents commented:

- “If supply chain can stabilize and material prices become more manageable, the next 18-24 months should show substantial sales growth.”

- “Demand is very strong, but product availability, labor shortages and price increases are making operations very difficult.”

- “I worry about inflation and an environment of higher taxes on small businesses as well as potentially higher capital gains taxes.”

As distributors move forward with healthy servings of both optimism and concern, several strategies have emerged from the lessons learned which they plan to execute going into 2022.

Phone and video calls will stay relevant to outside sales

Fifty-four percent of respondents agree that sales reps should rely on more phone/video after COVID-19. During the pandemic, account managers spent more time working over the phone and via video calls, and respondents believed they were able to take care of customer needs just as well even though their sales reps could not make sales calls.

Related: 2021 State of Sales in Distribution – Download Now

Post-pandemic, respondents expect to maintain a level of video and remote sales due to demand and efficiency. They commented:

- “I believe once the pandemic is over certain customers will still not allow face-to-face calls, meaning video calls will still take place.”

- “I think more phone or video communication is cheaper and more efficient.”

- “Our sales reps will use more virtual calls as part of the mix moving forward. In-person calls are still very important for relationship building.”

However, it’s clear that some executives felt relationships would have suffered had their sales reps been forced to stay at home much longer. Respondents commented:

- “Nothing can beat face-to-face selling and customer interaction.”

- “Lack of face-to-face interaction led to a less effective sales cycle, especially when demand had plummeted, and the low price became the predominant factor in decision-making.”

Digital capabilities and channels will stay in demand

Due to the pandemic, 53 percent of respondents plan to invest more in digital capabilities than previously planned.

Respondents saw a 730-basis point shift from other channels into touchless methods such as ecommerce, EDI, e-procurement, automated email-to-ERP, etc. They felt that this share will continue to grow, as it’s likely that many distributor customers will continue to work from home and many business buyers who set up accounts to purchase online will continue to use those channels post-pandemic.

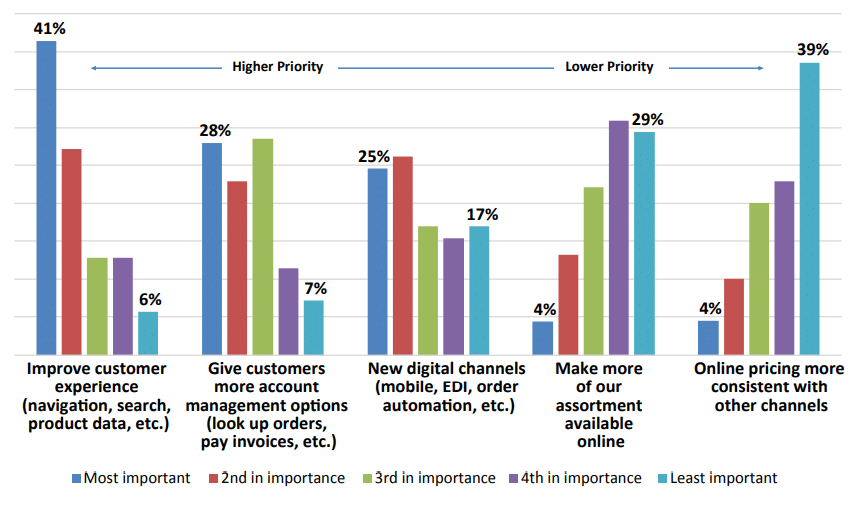

For the survey, respondents ranked five types of digital capabilities in terms of how they will prioritize them in the future.

- Improve customer experience (navigation, search, product data, etc.)

- Give customers more account management options (look up orders, pay invoices, etc.)

- New digital channels (mobile, EDI, order automation, etc.)

- Make more of our assortment available online

- Online pricing more consistent with other channels

Working from home will stay where it makes sense

While respondents expect most of their work-from-home employees to return to company facilities in the future, they still anticipate a 70% increase in the net portion of work-from-home individuals (17 percent versus a pre-COVID rate of 10 percent).

Sixty-nine percent of respondents believed their companies would offer more flexibility—although a few respondents viewed this more as a necessity than a company benefit. To compete for talent, these executives believed they would have to offer more opportunities for employees to work remotely. Respondents commented:

- “Pressure from employees will be for flexibility and some option to work from home. Not sure that this is best for our company, but it may be necessary for retention of key people.”

- “We have learned a lot in a year about people working from home. Many will continue working from home and come into the office one to three days per week. A handful, including IT, will work from home five days per week.”

Learn more about distributors’ experiences and lessons learned, including dozens of first-hand comments from respondents and resources about working from home, in our whitepaper for National Association of Wholesaler-Distributors, Pandemic Effects on Distributors, the third report in the series Adding Value in a Post-Pandemic World: New Leadership Strategies for Distributors.

Ian Heller is the Founder and Chief Strategist for Distribution Strategy Group. He has more than 30 years of experience executing marketing and e-business strategy in the wholesale distribution industry, starting as a truck unloader at a Grainger branch while in college. He’s since held executive roles at GE Capital, Corporate Express, Newark Electronics and HD Supply. Ian has written and spoken extensively on the impact of digital disruption on distributors, and would love to start that conversation with you, your team or group. Reach out today at iheller@distributionstrategy.com.