How distributors can build a cohesive value proposition

Past research and experience has shown us that most distributors use informal methods for creating a value proposition. This includes gathering data from the field sales organization and passing down legacy concepts of the value proposition.

And while a recent survey from MDM and Distribution Strategy Group found that distributors can confidently answer what the main benefits of their value propositions are, many of the value propositions expressed are undifferentiated and often not relevant.

They are undifferentiated because they say and offer essentially the same thing as their competitors. They are not relevant because they have not been tested with the market to see what customers and prospects care about the most.

It is a trap that many distributors fall into. They claim they deliver “what you need, when you need it, and where you need it.” At the same time, their competitors are claiming the exact same thing. Why should your customers believe you and, more importantly, why should they care? A technique called the “branding ladder” can be used to integrate disparate features and benefits into a more cohesive value proposition.

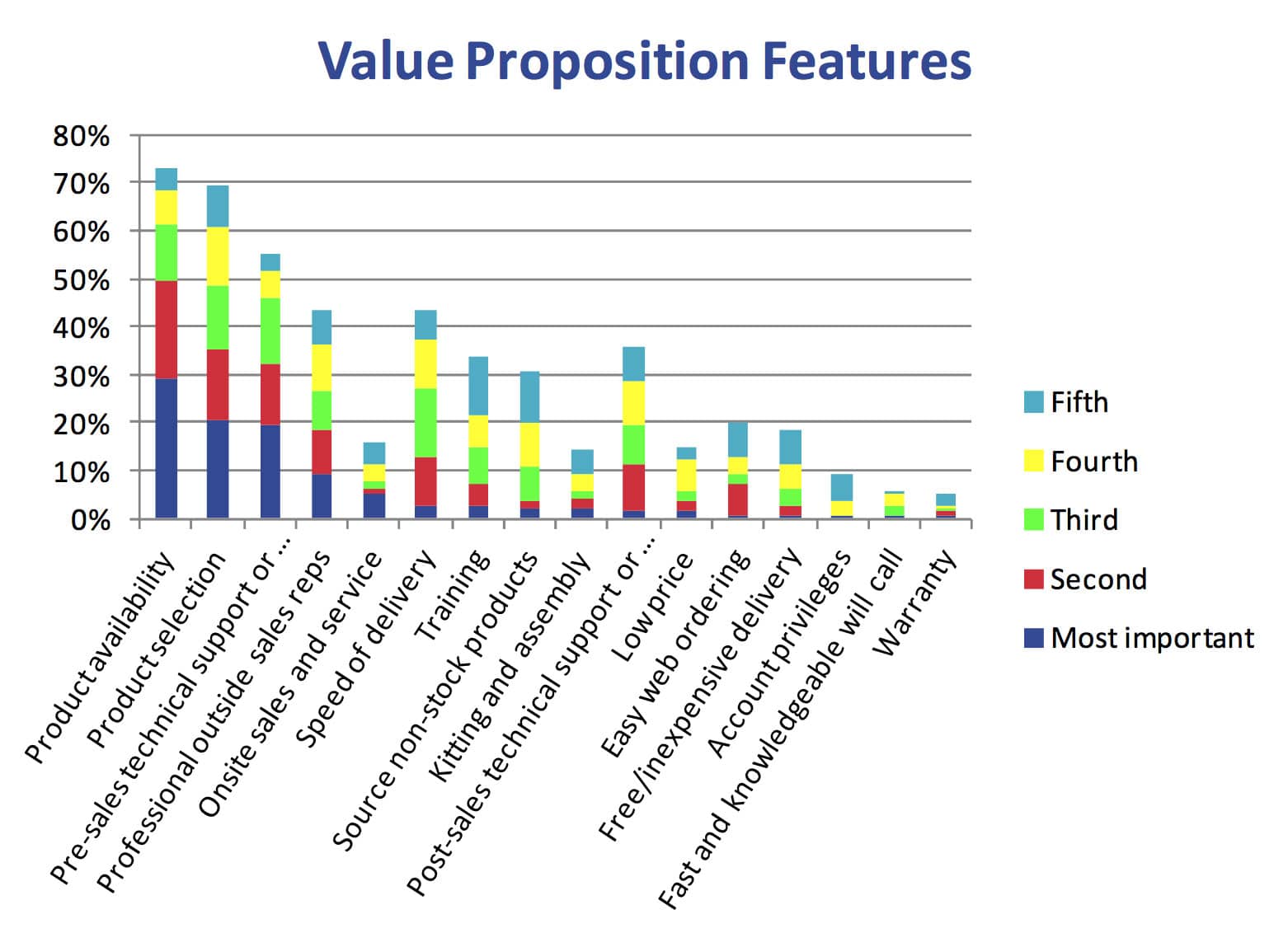

Features

In the survey, respondents were asked to name the top five features of their value propositions. As shown in Figure 1, product availability, product selection and pre-sales technical support/expertise were considered most important by the most respondents. In addition, a number of respondents rated these features as the second and third most important in their value propositions. Professional sales reps, speed of delivery and post-sales technical support were rated next highest overall.

Respondents also rated their own performance highly on these features. Nearly 90 percent said that their product availability was very good or good. Even though professional sales reps were the fourth most important feature, the performance of the sales reps was graded more critically than the performance of delivery speed and post-sales technical support.

In addition, respondents felt that the training they offer is very good even though they consider it an unimportant part of their value propositions.

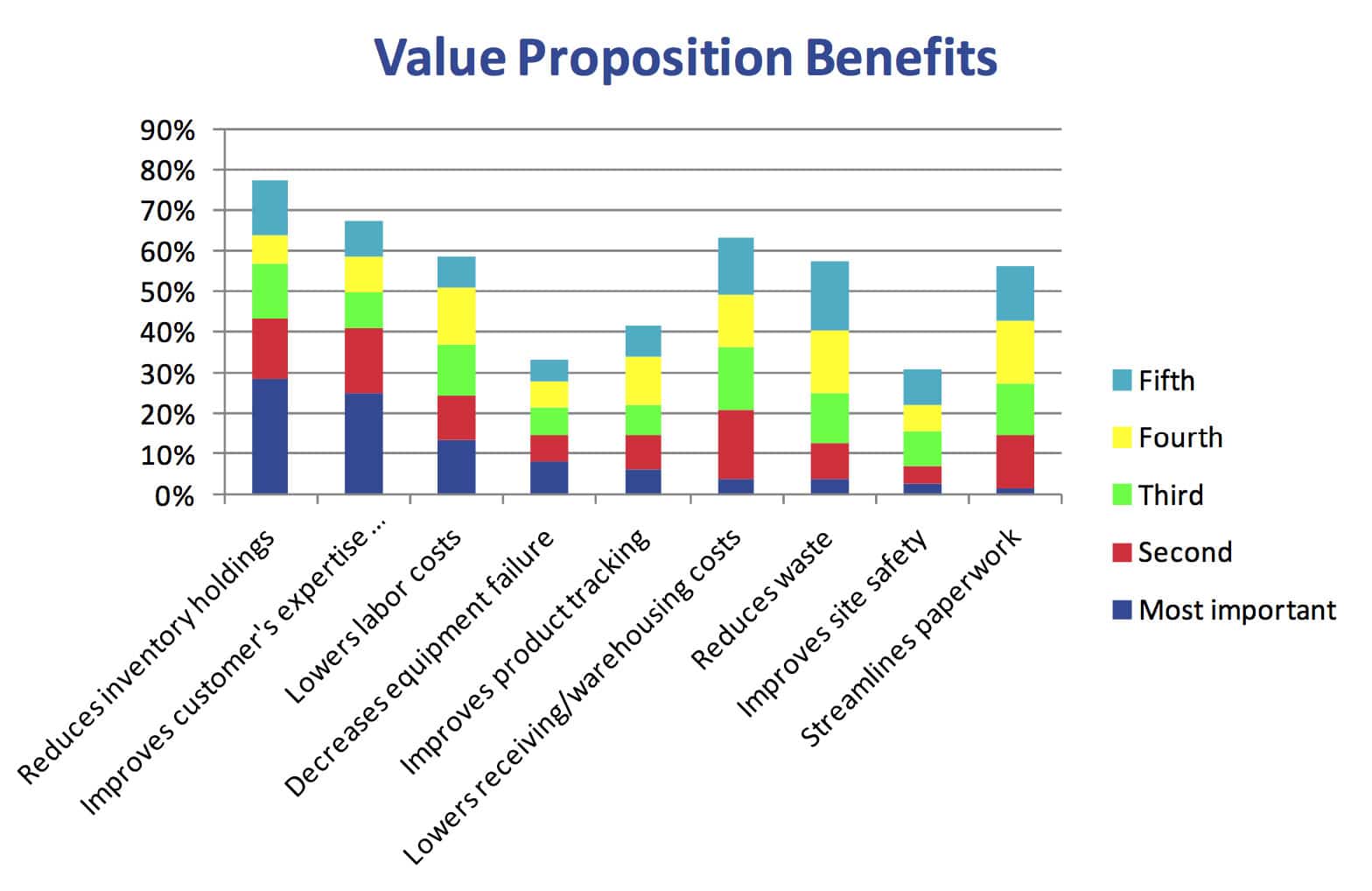

Benefits

Respondents were also asked to name the top five benefits of their value propositions. As shown in Figure 2, respondents believe that reducing inventory holdings, improving the customer’s expertise or helping lower the customer’s labor cost are the most important benefits in their value propositions. A number of respondents also chose lowering receiving cost, reducing waste and streamlining paperwork as being second, third or fourth most important.

Nearly 70 percent of respondents said that their performance on reducing inventory was good or very good. For most of the other benefits, 50 to 60 percent of the respondents said that their company’s performance was very good or good.

In general, there was less variation in the respondents’ assessment of their company’s performance on the benefits than on the features.

From our experience in surveying and interviewing the customers of distributors, we believe that there is actually significant difference in performance on the other benefits. The issue is that most distributors pay limited attention to measuring the benefits they deliver to their customers.

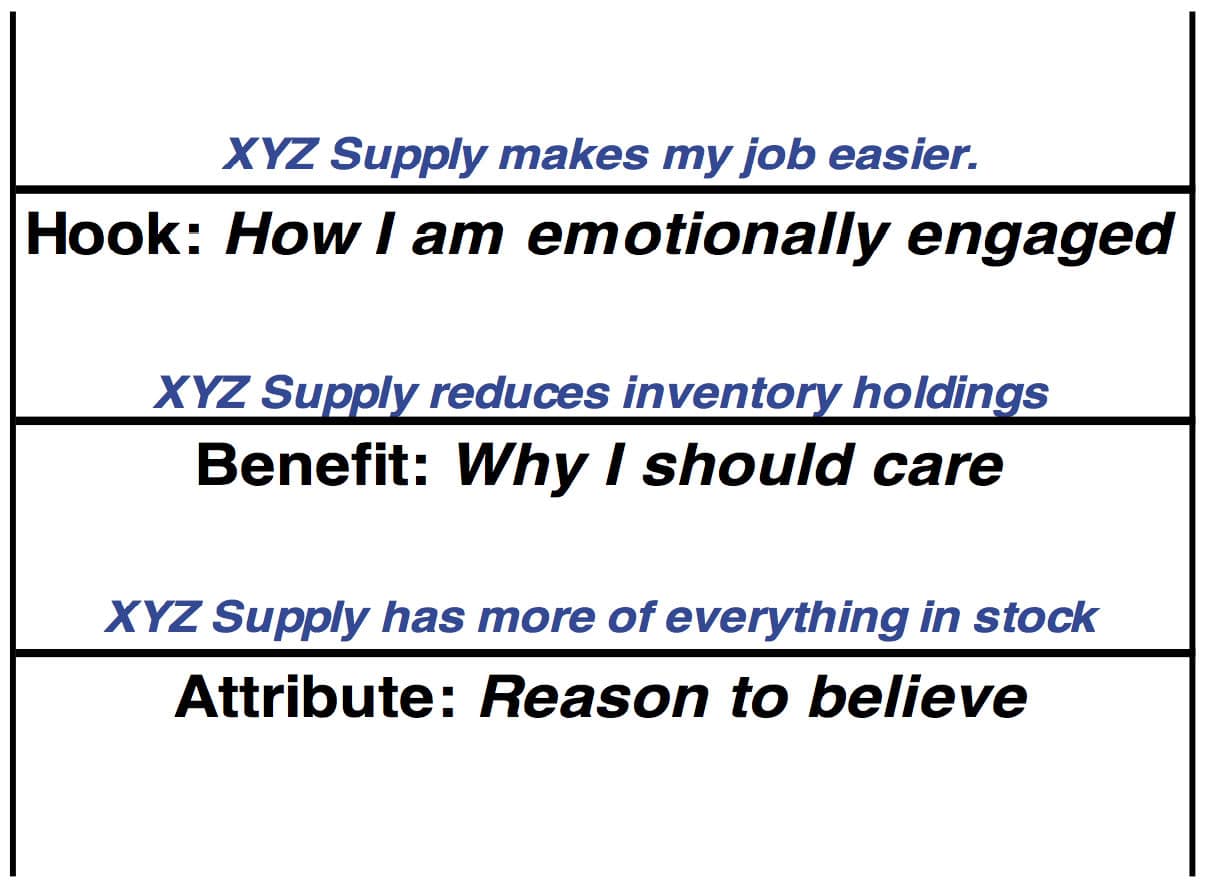

The Branding Ladder

The relationship between the features and benefits distributors offer is rarely described or quantified. A technique called the “branding ladder” can help relate different parts of the value proposition. Working with the branding ladder assumes three things before it can usefully applied:

- Features and benefits are not too heavily claimed by other competitors.

- The distributor has a unique, or at least relatively unique, offering related to the feature or benefit.

- Customers and prospects value the features and benefits that make up the value proposition.

The premise of the branding ladder is that features are related to benefits. In the figure below, a fictional distributor XYZ Supply has determined it has a unique advantage in in-stock availability of their products. It has determined that customers care about this and that competitors are not making strong claims about in-stock availability.

XYZ Supply uses in-stock availability as “a reason to believe.” The reason to believe provides the buyer with a basis to understand that the seller has an interesting feature as part of its overall value proposition. It is the initial pitch on the feature the distributor offers.

Through market research, XYZ Supply has also determined that customers really want to reduce inventory holdings and, by virtue of having more things in stock, XYZ’s customers can achieve that. XYZ also verified through primary market research that its solutions are more effective at reducing inventory holdings than its competitors’ offerings. This provides the customer with a reason to care about what XYZ offers.

The final step in laddering is to create the hook that will emotionally engage customers. In this case one possible hook is: “XYZ Supply makes my job easier.” Another possible hook is “XYZ Supply saves me money.”

Once XYZ Supply has created at least one ladder, it is in a position to test the branding ladder concept with the market to see how well it resonates. There are several ways to test this including focus groups, interviews and surveys.

The branding ladder provides a way out of the trap mentioned before. Many distributors, large and small, explicitly position on the claim that the distributor has better product selection, better availability and better delivery than their competitors. But if many distributors are making this claim or a variant of it, then their value propositions are undifferentiated (and likely irrelevant).

The way out of the trap is to relate the reason to believe to why the buyer should care. If the reason to care can be quantified, that is even better; a number of our clients are quantifying the economic benefit that they deliver to customers. The final step, if possible, is to create emotional engagement to the distributor brand.

Positioning has never been more important than it is today because of multichannel competition, frugal buyers and a diminished emphasis on relationships. Distributors of all sizes need to focus on sharper articulation and communication of their value proposition to stay relevant in the market. The key is to find out what really matters and to effectively relate attributes and benefits to an emotionally engaging message.

About the Survey

This research was conducted by Distribution Strategy Group with Modern Distribution Management. The research performed included interviews with nearly 20 distributor senior executives and an online survey taken by 250 participants across a variety of distribution sectors. There was heavier participation from industrial, electrical and safety. Other sectors include hardware, chemicals and plastics. Other participating sectors include HVACR and plumbing sectors, building materials, pulp and paper, janitorial, hardware, oil and gas, grocery and pharmaceutical. Over half were small distributors with less than $50 million revenue, one-third were mid-market with $50 million to $500 million revenue, and one-sixth were large with more than $500 million revenue. Almost half are focused on MRO, nearly a quarter on OEM customers, 13 percent an even blend of MRO and OEM, and 14 percent in other categories.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.