Join DSG on July 12 at 9 PT/12 ET when sales transformation expert Mike Kunkle will describe how distributors can design, implement and manage the right sales force for them. Register now for “The State of Sales in Wholesale Distribution.”

I’ve spent 39 years in the sales profession and for 32 of those, I’ve been engaged in some form of sales performance improvement work (sales training, sales effectiveness, sales transformation and/or sales enablement).

I’ve worked with a lot of sales forces and senior sales leaders, in many vertical industries. It’s been a fun journey, and I’m still enjoying it as much as ever.

Yet, I didn’t work full-time in wholesale distribution until December 2018, when I joined SPASIGMA, which combined with SPA and rebranded as SPARXiQ in 2019. This December marks my fifth anniversary in our noble profession. I have to say, I find wholesale distribution to be a fascinating industry.

In this post, I’d like to share some perspective from the point of view of a former-outsider turned-insider on the state of sales in wholesale distribution and offer a path for those who would like to maximize the potential of their sales forces.

The first step in maximizing a sales force’s potential is understanding the current state (a Situation Assessment, which is something I’ve written about before).

Let’s start with what makes it hard to offer blanket advice to distributors.

Wholesale Distribution is Not Just One Thing

Distribution is a widely varied sector that is segmented by:

Product Type, such as:

- NAICS Code 423: Merchant Wholesalers, Durable Goods

- NAICS Code 424: Merchant Wholesalers, Nondurable Goods

- NAICS Code 425: Wholesale Electronic Markets and Agents and Brokers

Ownership Structures, such as:

- Wholesale/Distribution Chain

- Independent Wholesalers

- Public and Private Firms

- Private Equity-Owned Companies

- Employee-Owned Companies

Market & Price Strategy, such as:

- Premium/Value-Added Provider

- Mid-Range/Market-Competitive

- Economy/Low-Cost Provider

Vertical Market Sub-Segments, such as:

- Paper and paper product

- Drugs and druggists sundries

- Chemical and allied products

- Lumber and other construction materials

- Professional and commercial equipment and supplies

- Hardware and plumbing and heating equipment and supplies

Wow, right? You’ll notice that even some of those sub-segments have multiple subsets. And then there are the various business models.

As an outsider coming into the profession, it’s a bit like being Kermit the Frog – “It ain’t easy being green.”

I find it remarkable that even people who have been in one segment of distribution for many years aren’t always familiar with the other sub-verticals. I’m not saying there aren’t similarities, common challenges, shared opportunities or other alignments; it’s just mind-boggling how diverse we are.

Wholesale Distribution is a Very Mature Vertical

Many distributors have been around for a long time, have many long-term employees and have worked with their key customers for decades (and often just as long with the leaders, buyers and other key contacts).

Contrast this with technology companies, many of which are start-ups or early-stage firms. Their focus is far heavier slanted toward new business development and growing the size of their customer base. Most distributors, on the other hand, have a loyal, long-term customer base at the core, with B, C and D accounts filling out their base. Established distributors tend toward a deeper focus on account management (account maintenance and growth), rather than new business acquisitions.

So, what does this mean, exactly?

<Start Disclaimer> This is tricky to dance around, so I’m just going to shoot straight. Keep in mind that everything I share next occurs on a bell curve or sliding scale. I’m not trying to poke you in the eye or insult anyone. I don’t know your business nor your employees. I’m forced to speak in generalities. </ End Disclaimer>

The Power of Momentum in a Mature Market

Many distributors operate on what I call momentum fuel. Their customers have been around for as long as anyone can remember, and their buyers have known their reps for years.

I supported a division of a Fortune 10 financial services firm in 2014 (which operated much like a distributor, albeit a different product set), where the sales reps knew the owners of their customers’ firms so well that the reps were invited to the owners’ kids’ weddings. (Yes, that’s plural. It wasn’t just one isolated incident.)

While there are bespoke engineered solutions in much of distribution, customers order products, use the stock and reorder. Yes, seller/customer relationships often run deep. Relationships still matter. And growth does occur because good reps uncover needs, solve problems or make suggestions.

But if the rep retired tomorrow, their territory would likely go on producing, unless their replacement was incompetent. And this age-old pattern will continue until something changes on the buyer-side of the equation or something external happens to encourage (or force) change, such as:

- A pandemic

- A recession

- An acquisition

- A new CEO

- A CFO implements a new purchasing system or policies

- AI or other purchasing analytics uncover new options

- Declining sales performance tightens budgets

- Worsening supply chain issues force using multiple vendors

- Significantly rising costs cause more pricing scrutiny

- A new, more efficient competitor emerges that lowers pricing expectations

- A marketplace emerges, allowing buyers to easily compare across vendors

- A new, sharp, competitive sales rep lures the customer away

This is a lot like Newton’s first law in physics. A body in motion tends to stay in motion, unless disrupted by an external force.

Guess what? Buyer behavior is changing. Now, due to what I shared above about the diverse nature of wholesale distribution – not every sub-sector is feeling the pain of change yet. It varies.

But trust me when I tell you, it’s coming for your company, at some point. It may be as slow as a glacier, or as fast as a tsunami, but when it hits you, the landscape is going to change forever.

In the story above about the division of the Fortune 10 financial services corporation, I saw this firsthand. As the owners of the companies that they served began to retire, and their children took over the businesses, the attitude toward the seasoned sellers and the company radically changed.

The new owners didn’t care that we had helped them through the financial crisis six years prior. They didn’t care how many times sellers had golfed with their dad, bought expensive dinners, or even that the sellers attended their wedding. The attitude was much more, “What have you done for me lately?” and it was all about the business. Some of you have already felt this. Others, not as much. As I said – it’s coming.

Wholesale Distribution Hasn’t Typically Trained Sellers

I love what Dirk Beveridge is doing for our profession and follow his We Supply America tour on LinkedIn, as well as his other posts. I know he’s a friend of Distribution Strategy Group, as well. Here’s a quote from his research that struck me, recently:

"82% of distribution leaders believe that attracting and retaining the talent needed for growth will be THE challenge for the next decade.”

~ Research from Dirk Beveridge

This is so true, and I’m glad it’s being recognized. There are other important strategies, but a big part of retaining is training. Historically, due to a variety of factors, including tight profit margins and a reliance on hiring “genuine, outgoing people with interpersonal skills, a sense of humor, and a good attitude,” distributors have not invested heavily in sales talent development such as sales skills training, negotiation skills training and sales coaching training.

Product training is provided for obvious reasons. It’s often done by manufacturers and suppliers for free and occasionally by an in-house subject matter expert (free, other than their time).

When there is sales training, it’s often event-based, which is known not to foster adoption, behavior change or mastery, and the training is not often reinforced or wrapped into the fabric of the company and how they operate and manage.

For that reason, most don’t see a lift in sales performance or a return on their investment. The right sales training, chosen well, implemented effectively, and reinforced and coached, can radically improve sales performance. For these leaders, however, if they haven’t seen it, it doesn’t seem real or possible.

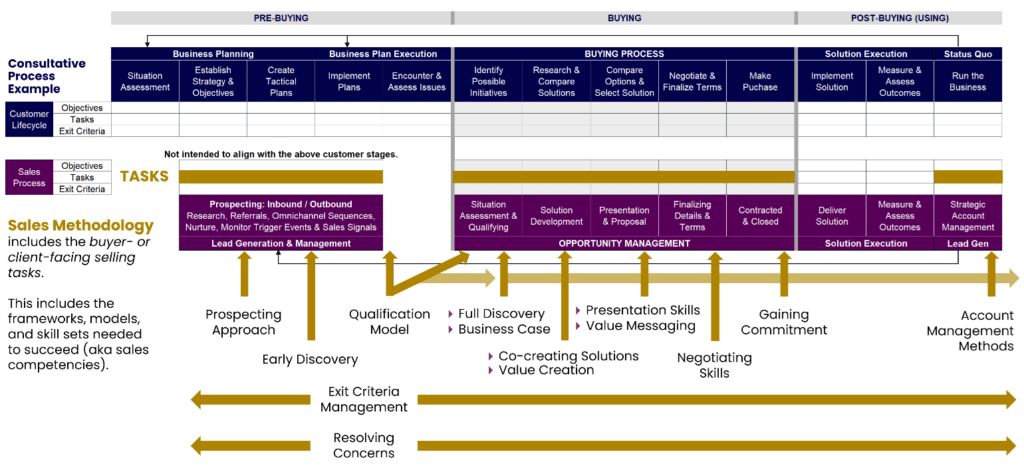

There’s No Formal Sales Process or Sales Methodology

Despite long customer relationships, buyer acumen is not well documented. It’s more like tribal knowledge distributed among the sales force. If it is documented, it takes to be internal perspective, rather than being based on external, expert research of the company’s real buyers and others like them.

As a result, the sales process is not aligned to the buying process (often referred to as the buyer’s journey). It tends to be informal (if there even is one), loosely documented and not managed closely. Many distributors still don’t have CRM systems, or if they do, don’t use them well. And rather than an aligned sales methodology that is taught and coached, selling remains very much a seller-driven, free-for-all.

Comparing Seller Competencies: Distribution vs. All

In case this seems harsh, it’s not intended. It’s just factual observation. There’s also data to support the difference in sales competencies in wholesale distribution.

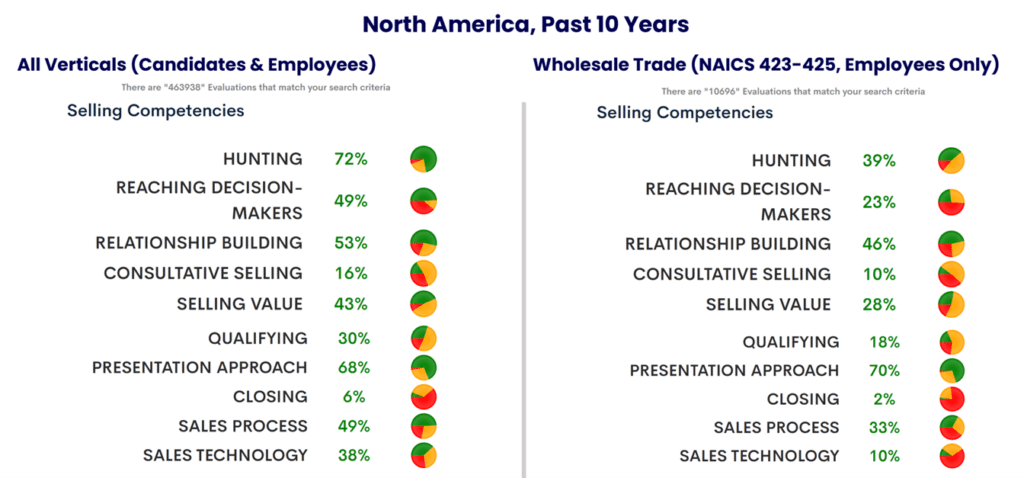

Objective Management Group has been assessing the competencies of sales leaders, sales managers and salespeople for over 30 years. I have access to their data through a partnership. Here’s a view of 10 tactical selling competencies, just over the most recent 10 years, rather than the full 30-year history. This view shows the Percentage of Salespeople Who are “Strong” in the Competency:

On the left is the data for all verticals, including wholesale distribution. It includes the 463,938 salespeople assessed in this timeframe and the scores (the percentage rated strong) for the 10 competencies. It’s all the data, so it includes the top 5% elite performers, as well as the bottom-tier poor performers, and everyone in between.

On the right, is just the data for NAICS Code 423-425, which you’ll recognize as wholesale distribution. There are 10,696 sellers included in this timeframe. Pause to compare the percentages on both sides.

Telling, isn’t it? We lead only in Presentation Approach (by only 200 basis points, but still leading), which means that we do not rush to make formal presentations too early and tend to make them to the right audience. Some of the differences are quite significant.

Added Note: 643 of the sellers in wholesale distribution scored as Elite. That’s 6% of all assessed, versus 12.7% of Elite sellers in the general market, which includes wholesale distribution. I don’t have the ability to exclude wholesale distribution from the general market, but if I could, the percentage of the remaining Elite sellers would obviously increase.

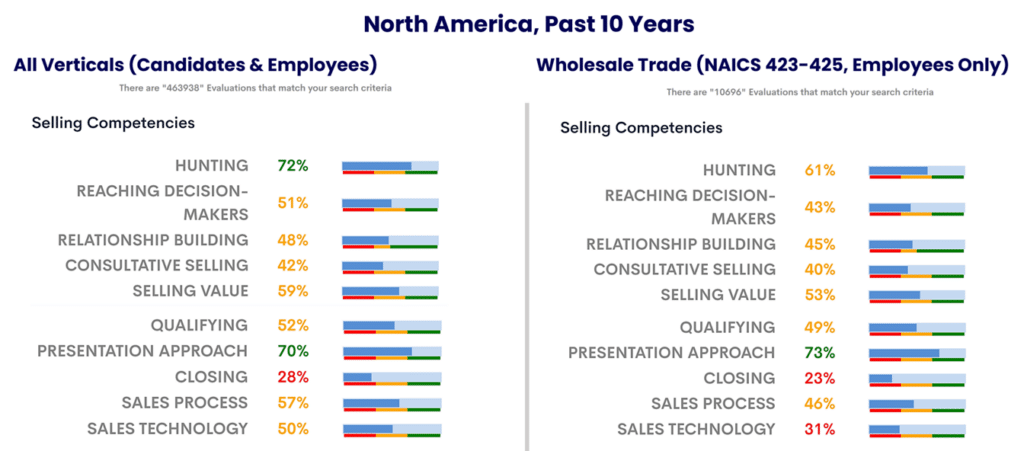

Here’s another view, including the Average Competency Score for the 10 tactical selling competencies:

Here’s the good news. While there is other data that suggests that we should improve how we hire sales roles, the above data represents a tremendous opportunity for distributors, with their current sales force. Why? Because these tactical selling competencies are completely trainable!

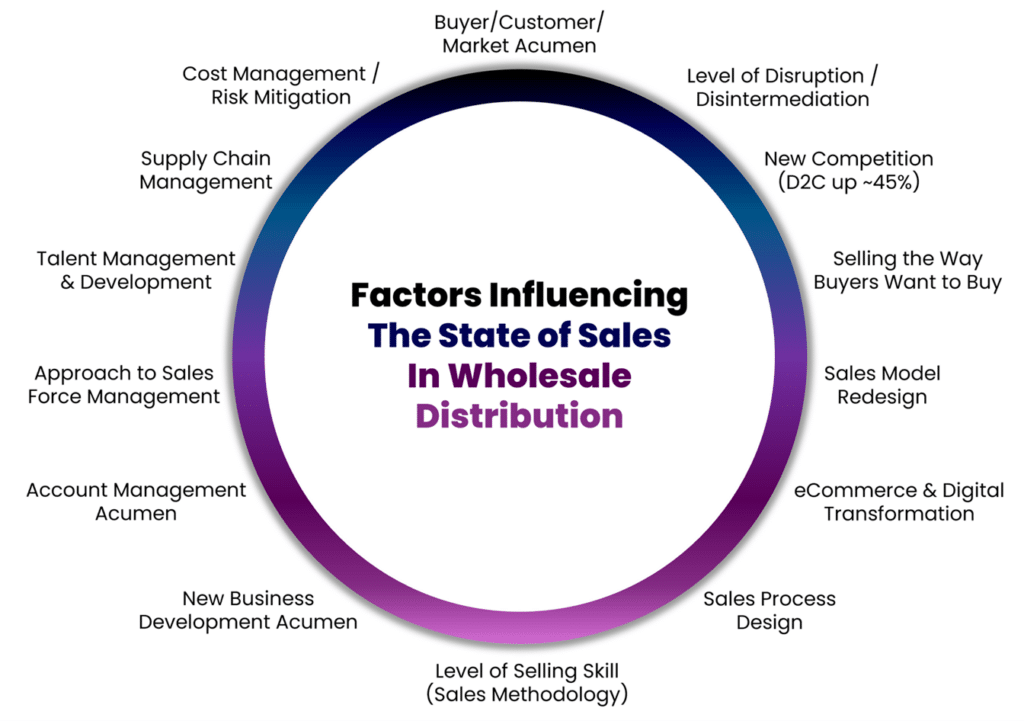

And (are you ready?), this is just one slice of the factors influencing the state of sales in wholesale distribution.

What are the rest of the factors?

Factors Influencing the State of Sales in Wholesale Distribution

As you consider the above factors, note that the level of disruption you’re experiencing is a gauge of how critical it is to act, but not something specific for your sales leader to do.

So, shown another way, here’s a list of the actionable factors from the chart above that are sales-related, or that will affect the sales leader and sales force:

- Buyer/Customer/Market Acumen

- Selling the Way Buyers Want to Buy

- Sales Model Redesign

- eCommerce & Digital Transformation

- Sales Process Design

- Level of Selling Skill (Sales Methodology)

- New Business Development Acumen

- Opportunity Management Acumen

- Account Management Acumen

- Talent Management & Development

- The Approach to Sales Force Management

- Creating Actionable Plans

With these identified, the next step is to assess how these factors are affecting your company, specifically, and what actions to take.

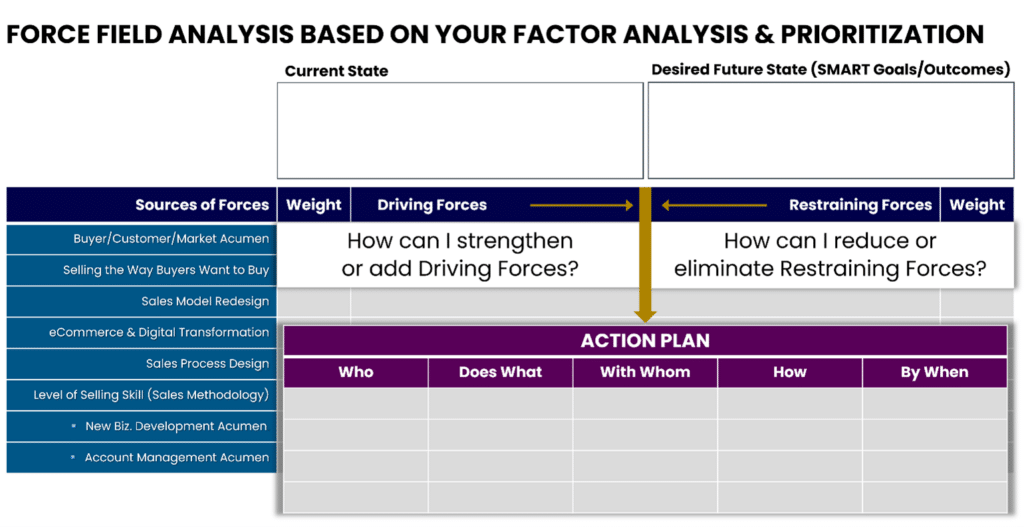

To do this, I recommend a Factor Analysis & Prioritization, leading to a Force Field Analysis, to create an Action Plan.

A Factor Analysis & Prioritization allows to assess:

- Where are you today, with each factor (the Current State)?

- Where should you be (the Desired Future State)?

- What’s the urgency level?

You can add Difficulty to Address, Gap Size or anything else that makes sense to you, but this approach is effective at assessing your landscape. With a prioritized list (based on the size of the gap and your urgency rating), you can conduct a Force Field Analysis and use it to create an Action Plan.

I’ve written about this diagnostic planning tool here before. To learn more, visit this post and scroll down to the section titled “Conducting a Force Field Analysis.”

The primary difference in this Force Field Analysis is that the Sources of Forces are your prioritized factors from the previous analysis.

What’s Next?

If you would like to see even more data and detail on the current state of sales in distribution, as well as your actionable path forward, join me for a webinar on July 12 at 9 PT/12 ET. Register now to watch live or to get a link after the event to watch on demand.

Mike Kunkle is an internationally recognized expert on sales enablement, sales effectiveness, sales training, sales coaching, sales management, and sales transformations.

He’s spent over 30 years helping companies drive dramatic revenue growth through best-in-class enablement strategies and proven effective sales systems.

Mike is the founder of Transforming Sales Results, LLC where he designs sales training, delivers workshops, and helps clients improve sales results through a variety of sales effectiveness practices and advisory services.

He collaborated to develop SPARXiQ’s Modern Sales Foundations™ curriculum and authored their Sales Coaching Excellence™ and Sales Management Foundations™ courses.

Mike's book, The Building Blocks of Sales Enablement, is available on Amazon, with others coming soon in 2026, starting with The CoNavigator Method for B2B Selling.