The Marketplace Model Works Fine Globally; the Traditional Distribution Model Does Not

On June 2, Grainger announced it was selling its Fabory subsidiary to Dutch private equity firm Torqx Capital Partners. Fabory is a specialist distributor of fasteners and fastener-related products to more than 60,000 customers in Europe.

Grainger reported some serious impairment charges against Fabory in its first quarter 2020 10Q; more than $175M by our reading. That’s a lot of money for a business the company bought in 2011 for $344 million. On its website, Fabory reports annual revenues of about $248 million.

Fabory primarily operates in 11 European countries: the Netherlands, Belgium, the Czech Republic, France, Hungary, Poland, Portugal, Slovakia, Spain, Romania and the United Kingdom. Within the past few years, Amazon Business has moved into three of these countries: France, Spain and the United Kingdom. The business unit has also set up shop in Germany and Italy – and is undoubtedly targeting more European nations.

Notably, Grainger took a $139 million writedown on its UK-based Cromwell business in 2018. Some analysts expect Grainger to divest this business soon, too, more or less completing its withdrawal from Europe as Amazon Business expands there.

Correlation or Causality?

It’s fair to question whether these events are correlated or it’s just a coincidence that Amazon Business is (apparently) thriving in various international markets while Grainger is not. In my opinion, it’s most likely that these aren’t directly correlated but, instead, related to the inherent global scalability of the traditional distribution model vs. Amazon’s marketplace model.

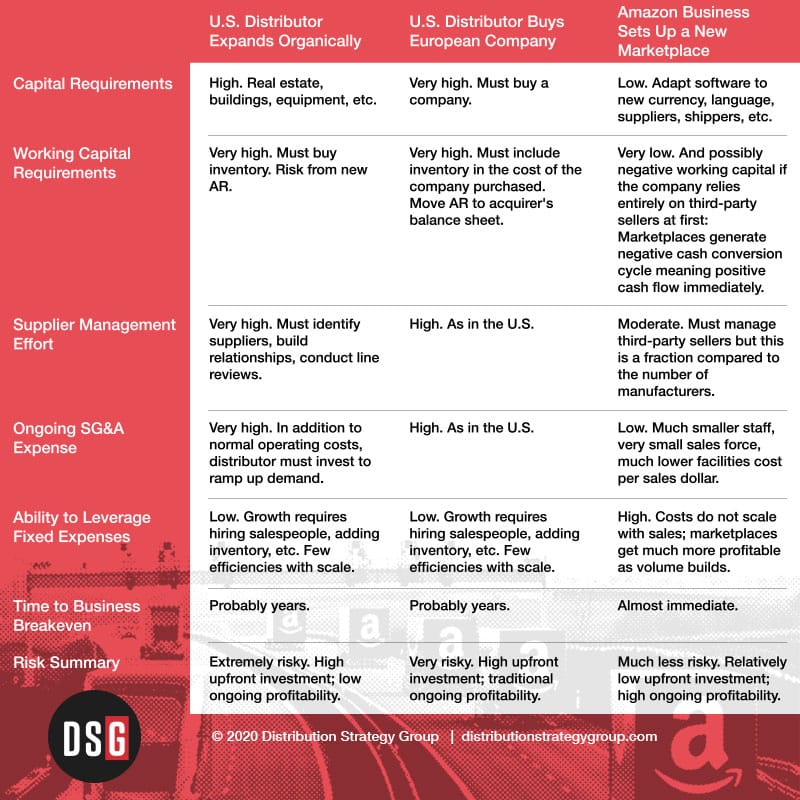

Consider three scenarios:

- A U.S. distributor decides to expand organically in Europe.

- A U.S. distributor buys an existing European distributor.

- Amazon Business sets up shop in Europe.

The start-up costs, the ongoing expense and the risks of the first two options are much greater than the third. The ongoing profitability of a successful marketplace actually improves automatically and dramatically with scale, as well:

Unlike the other two modes of international expansion, marketplaces offer relatively low start-up expenses, a fast breakeven and low risk. These same dynamics are true in retail, as well, which is why very few traditional retailers have made substantial global progress while Amazon seemingly thrives in least 17 countries.

Grainger vs. Amazon Business in Europe: Not Correlated but Inevitable

I don’t believe Amazon Business pushed Grainger out of Europe. The timing is most likely a coincidence. Grainger took on a much more difficult task – more expensive, higher risk, less profitable – than did Amazon Business, so it should be no surprise that one company succeeded where the other withdrew.

The real lesson here is that marketplaces are going to continue to take share from traditional distributors – even strong, well-operated companies like Grainger. These relatively new business models simply have advantages grounded in a set of technological developments that present a highly compelling value proposition to customers while offering extraordinary growth opportunities for marketplace owners.

This will drive continued global expansion by marketplace companies and will be matched by many stories of traditional distributors withdrawing from countries, continents, product markets and customer segments.

Disruption has hit wholesale distribution. The evidence is all around us, and it’s past time for industry executives to reformulate their strategies as a result.

I’d love to hear your feedback. Please post a comment below or email me at iheller@distributionstrategy.com.

Ian Heller is the Founder and Chief Strategist for Distribution Strategy Group. He has more than 30 years of experience executing marketing and e-business strategy in the wholesale distribution industry, starting as a truck unloader at a Grainger branch while in college. He’s since held executive roles at GE Capital, Corporate Express, Newark Electronics and HD Supply. Ian has written and spoken extensively on the impact of digital disruption on distributors, and would love to start that conversation with you, your team or group. Reach out today at iheller@distributionstrategy.com.