Voomi Supply CEO RJ Cilley on the future of ecommerce in HVAC markets.

Marketplaces

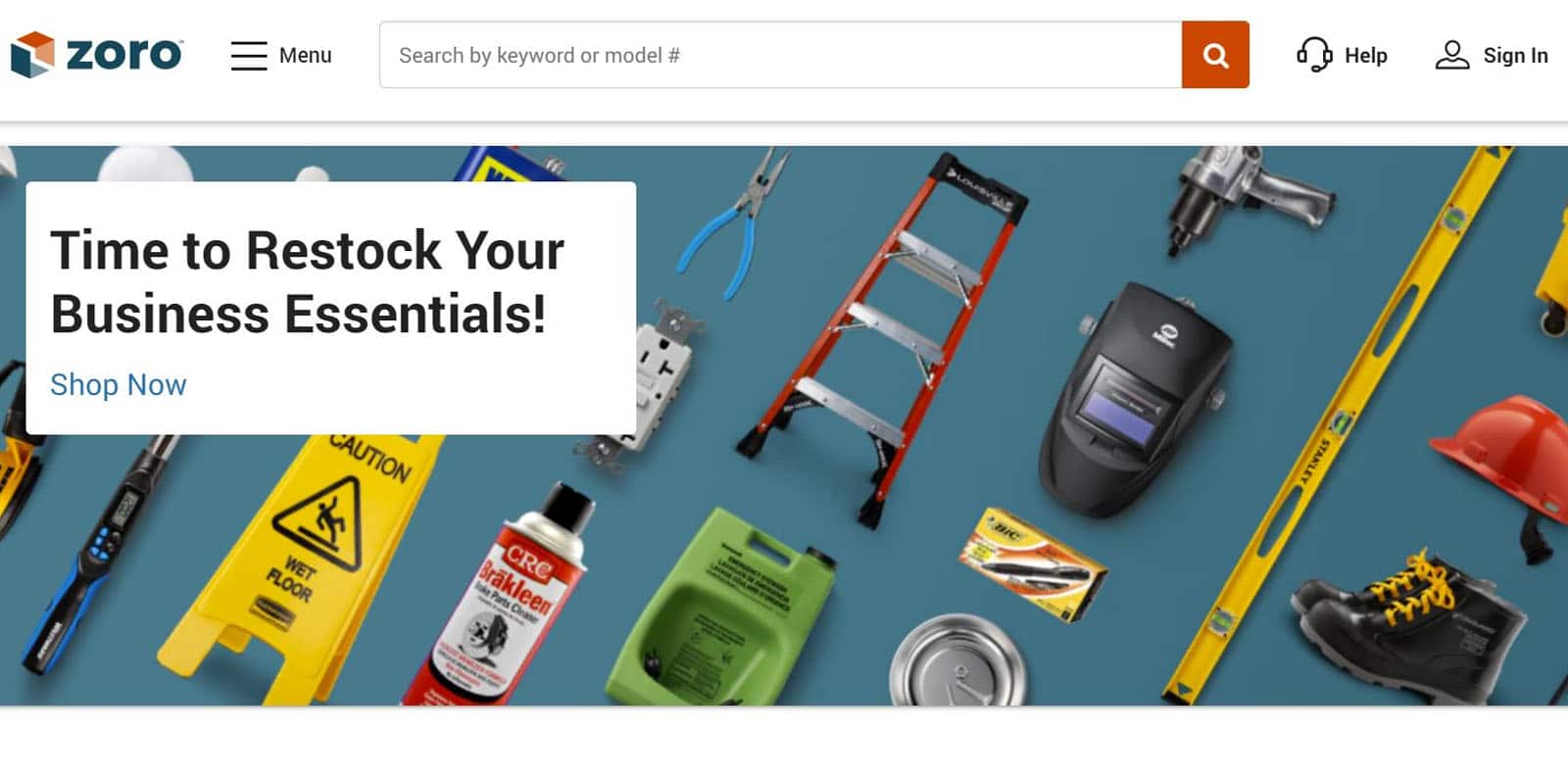

How Zoro.com helps distributors succeed online.

Big retailers are making big inroads into distribution.

Convince decision-makers the ends (a marketplace) justify the means.

For digital transformations to work, prioritize learning and model validation.

Payments are a dilemma for distributors when it comes to marketplaces, but it doesn’t have to be.

Distributors must step up or risk losing their hold on the B2B market.

Build a process to evaluate online-channel partners to determine if partnering with them is profitable.

It’s important to follow best practices when building a distributor marketplace.

How can distributors differentiate amid stiffening competition from B2B marketplaces?

Where do you start in evaluating your existing technology – and then building the right set of technology solutions for your customers based on

Is there a way to compete with digital giants like Amazon while simultaneously expanding your customer base to markets you can’t reach through traditional

ow your distributor peers are planning to enhance and augment their ecommerce capabilities over the next three years – and how you can differentiate

Mark Dancer shares how distributors can reimagine physical stores so that they remain relevant long into the future.

Learn about growth options for master distributors, including how they might work with certain marketplaces.

Berkshire eSupply benefits by making its products available on hundreds (and potentially thousands) of websites operated by small and midsize industrial distributors. It’s a great plan,

Keeping the customer at the center is key to providing the product data a customer needs to find a product, then transact.

Marketplaces represent an existential challenge for master distributors.

As many distributors wonder how to respond to the breathtaking growth of Amazon Business, Office Depot has gone on to create what looks like

Platforms are indeed “eating the world.” Most distributors can still choose whether they will do the eating or be the meal. This post presents

Upcoming Programs

Join us on July 23, 9 PT/12 ET, as we discuss how companies are building more resilient, agile supply chains.

Join us on Thursday, July 24, 2025 at 9 PT/12 ET for a new AI News and Gurus: The Show for Intelligent Distributors

Join us on July 30, 2025 at 9PT/12ET as we delve into the state of distributor sales to enhance your customer experience.

Join us on Aug 6, 2025 at 9PT/12ET as Brian Gardner shares what the most forward-thinking distributors are doing to improve sales.

Voomi Supply CEO RJ Cilley on the future of ecommerce in HVAC markets.

How Zoro.com helps distributors succeed online.

Big retailers are making big inroads into distribution.

Convince decision-makers the ends (a marketplace) justify the means.

For digital transformations to work, prioritize learning and model validation.

Payments are a dilemma for distributors when it comes to marketplaces, but it doesn’t have to be.

Distributors must step up or risk losing their hold on the B2B market.

Build a process to evaluate online-channel partners to determine if partnering with them is profitable.

It’s important to follow best practices when building a distributor marketplace.

How can distributors differentiate amid stiffening competition from B2B marketplaces?

Where do you start in evaluating your existing technology – and then building the right set of technology solutions for your customers based on

Is there a way to compete with digital giants like Amazon while simultaneously expanding your customer base to markets you can’t reach through traditional

ow your distributor peers are planning to enhance and augment their ecommerce capabilities over the next three years – and how you can differentiate

Mark Dancer shares how distributors can reimagine physical stores so that they remain relevant long into the future.

Learn about growth options for master distributors, including how they might work with certain marketplaces.

Berkshire eSupply benefits by making its products available on hundreds (and potentially thousands) of websites operated by small and midsize industrial distributors. It’s a great plan,

Keeping the customer at the center is key to providing the product data a customer needs to find a product, then transact.

Marketplaces represent an existential challenge for master distributors.

As many distributors wonder how to respond to the breathtaking growth of Amazon Business, Office Depot has gone on to create what looks like

Platforms are indeed “eating the world.” Most distributors can still choose whether they will do the eating or be the meal. This post presents

Voomi Supply CEO RJ Cilley on the future of ecommerce in HVAC markets.

How Zoro.com helps distributors succeed online.

Big retailers are making big inroads into distribution.

Convince decision-makers the ends (a marketplace) justify the means.

For digital transformations to work, prioritize learning and model validation.

Payments are a dilemma for distributors when it comes to marketplaces, but it doesn’t have to be.

Distributors must step up or risk losing their hold on the B2B market.

Build a process to evaluate online-channel partners to determine if partnering with them is profitable.

It’s important to follow best practices when building a distributor marketplace.

How can distributors differentiate amid stiffening competition from B2B marketplaces?

Where do you start in evaluating your existing technology – and then building the right set of technology solutions for your customers based on

Is there a way to compete with digital giants like Amazon while simultaneously expanding your customer base to markets you can’t reach through traditional

ow your distributor peers are planning to enhance and augment their ecommerce capabilities over the next three years – and how you can differentiate

Mark Dancer shares how distributors can reimagine physical stores so that they remain relevant long into the future.

Learn about growth options for master distributors, including how they might work with certain marketplaces.

Berkshire eSupply benefits by making its products available on hundreds (and potentially thousands) of websites operated by small and midsize industrial distributors. It’s a great plan,

Keeping the customer at the center is key to providing the product data a customer needs to find a product, then transact.

Marketplaces represent an existential challenge for master distributors.

As many distributors wonder how to respond to the breathtaking growth of Amazon Business, Office Depot has gone on to create what looks like

Platforms are indeed “eating the world.” Most distributors can still choose whether they will do the eating or be the meal. This post presents