If you want to find easy wins to improve your bottom line, invest in Customer Experience (CX).

There are many examples of companies that focus on CX that outperform those that do not.

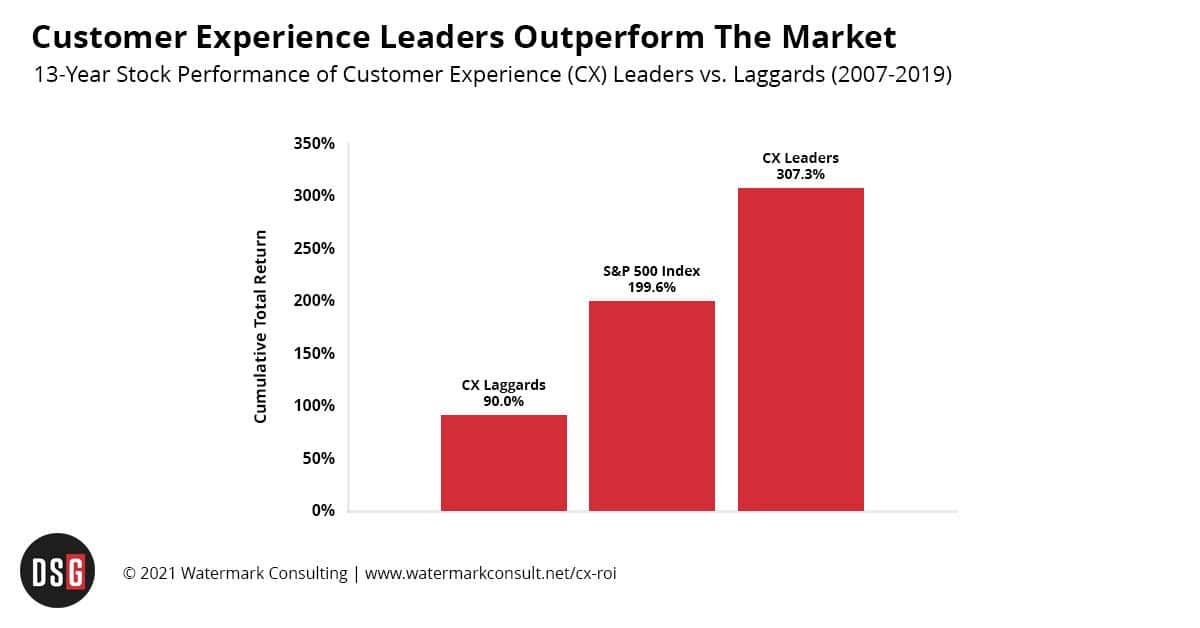

But how can surveying your customers or listening to them complain result in more to your bottom line? Watermark Consulting dug into this very question. They ran an experiment where they tracked the S&P500 against the bottom 10 and top 10 customer experience-ranked publicly traded firms. (The top and bottom 10 were identified via publicly available third-part customer experience rankings from Forrester, Temkin Group and Qualtrics.)

Spoiler alert: The top 10 firms’ stock performance outperformed the S&P500 by a wide margin.

Customer Experience leaders understand that while they are trying to increase customer satisfaction and NPS scores, they are doing so in a strategic way that grows the bottom line. For a customer experience program to be successful, it must be diagnostic and tied to financial metrics. Many Customer Experience initiatives make the mistake of simply taking their NPS score and not digging further.

Every distributor is different. The survey metrics that matter to one organization may not matter for your own. This means you must have a good in-depth survey solution in place.

A simple free or inexpensive one-question survey will not give you the data you need to know which Voice of the Customer metrics will drive key financial indicators for your business.

Look for a survey that can be finished in 5 minutes or less but still provides ample data and is ongoing so you are able to keep up on these metrics.

Let’s look at an example.

Right now, everyone is focused on inventory. Two financial KPIs for inventory are Average Order Value and Lines Per Order. The goal is to drive both of these metrics higher. But first you need your customer’s voice.

You can survey the customer and ask a couple questions such as:

- “Are you satisfied with our inventory availability?”

- “Are you satisfied with how we communicate lead times and delays?”

If you were then to run an analysis, it is very likely that your customers that have the highest Average Order Value and Lines Per Order are also the most satisfied on these two questions. So, now we have found the financial metric to target, and we have found a survey metric that ties into it.

What Next?

We have done the science part of Customer Experience. This is where the art comes in.

Now you need to get your hands dirty, and talk to employees and customers. Take some of the customers that are frustrated on the questions above and dig into what may be causing the delays for them or the lack of communication. In this instance, it will be easier to address the lack of communication than the delays especially with the ongoing supply chain issues. Plus, in my experience, lack of communication of potential problems is a much bigger driver of customer satisfaction than the problem itself.

People understand things happen – but they need to be kept in the know and given valid reasons. For instance, one issue could be the communication between the warehouse and the customer service reps responsible for an account.

I have seen many examples of an order picked and sent without important items. But no one tells the CSR and the customer finds out by opening up the box.

You can’t blame them for being extremely frustrated.

Now back to the CX science.

There are many ways to fix this issue; you need to identify what works best for you. You could set up automated emails or texts to the customer (before they get that package), and you could have a notice ping on the CSR’s computer. The warehouse staff could be prodded by a similar notice and be required to tell the CSR.

Whatever way you address the problem, you can now monitor progress through the survey questions above and see if the procedure put in place is working.

The important thing is now that we have tied a survey metric to a key financial KPI and put in a process to improve on that. We are now able to measure and pretty quickly see if the procedure is affecting change. That’s going to be so much more effective than waiting to see the financials down the road – a lagging indicator.

A Customer Experience program can drive increases in bottom-line revenue and help the team work together more effectively. Solid data shows CX leaders based on revenue outperform the laggards. Which will you be? Learn more about how you can make a small change in the percentage of loyal customers to drive a significant impact on profitability.

As Chief Operations Officer of a Distribution Strategy Group, I'm in the unique position of having helped transform distribution companies and am now collaborating with AI vendors to understand their solutions. My background in industrial distribution operations, sales process management, and continuous improvement provides a different perspective on how distributors can leverage AI to transform margin and productivity challenges into competitive advantages.