When it comes to positioning and messaging, the overwhelming majority of distributors have the following three things in common:

- About 90 percent believe that they deliver more value than their competitors for a comparable price.

- More than 88 percent of distributors place a large emphasis in their messaging on a handful of features: product selection, availability, speed of delivery, pre-sales technical support, and professional sales representatives. If everybody is messaging on the same items, it means that nobody is really differentiating.

- Nearly 70 percent of distributors use informal methods for positioning and messaging.

This article, the first in a two part series, explains why distributors hold this belief about value and shows how distributors can develop differentiated messaging around a broader set of features. The next article in the series shows how benefit-oriented messaging is used effectively by the largest and most successful distributors in the industry.

Study Summary

This research was conducted by Distribution Strategy Group in conjunction with Modern Distribution Management. The research performed included interviews with nearly 10 distributor senior executives and an online survey taken by 170 participants across a variety of distribution sectors. There was heavier participation from industrial, electrical/electronics, building, safety, hardware, and chemicals and plastics. Other participating sectors include HVACR and plumbing sectors, building materials, pulp and paper, janitorial, hardware, oil and gas, grocery, and pharmaceutical. Over half are small distributors with less than $50M revenue, over a quarter are mid-market with $50 million to $500 million revenue, and 18 percent large with more than $500 million revenue. Almost half are primarily focused on MRO, nearly a quarter are focused OEM customers, thirteen percent are an even blend of MRO and OEM, and fourteen percent are in other categories.

Positioning on Value and Price

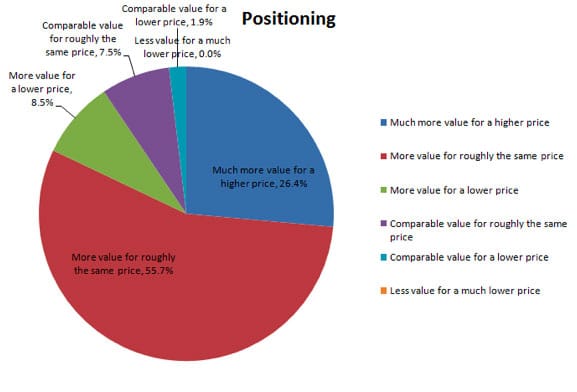

Positioning around value offered versus price charged is a key aspect for any business. To get a better understanding of how distributors view their value versus price positioning in the market, we asked each respondent to select the positioning that best describes their business from the choices shown in Figure 1 at the right.) The survey revealed that 82 percent of the distributors who responded are positioning around value: either “much more value for a higher price” or “more value for the same price.” All of the OEM distributors are positioned around value. An additional 8.5 percent of distributors believe they offer more value for a lower price. Only a handful of respondents are positioned around price: either “comparable value for a lower price” or “less value for a much lower price.”

It is stunning that 90 percent of the respondents perceive that they deliver more value than their competitors for a similar price or lower. All things being equal, we would expect that 55 to 65 percent of companies would position around value instead of price. Although we have seen similar trends in other markets where suppliers have an inflated sense of the value they offer, none is as stark as in the distribution market. The most significant contributing factors to this value inflation phenomenon are:

- Price pressure — The ability to purchase products over the web combined with the downturn has created real price pressure for all businesses. Rather than lose deals or lower prices, many distributors provide additional services, often at no charge to the customer. James Teat, CEO of Axcess Technology Source, notes that “It used to be the case that if you offered a quote, a customer might solicit one other quote from another local supplier. There was not a lot of competition on price. Today, with the Internet, a customer may find an out of state distributor that has a better price than a local distributor. The best way to differentiate ourselves is to offer add-ons or other value that other suppliers don’t offer.” In addition, the distributor is frequently taking over a function from the customer because the customer has reduced staff size. The result is a higher value for the customer with minimal or no price change.

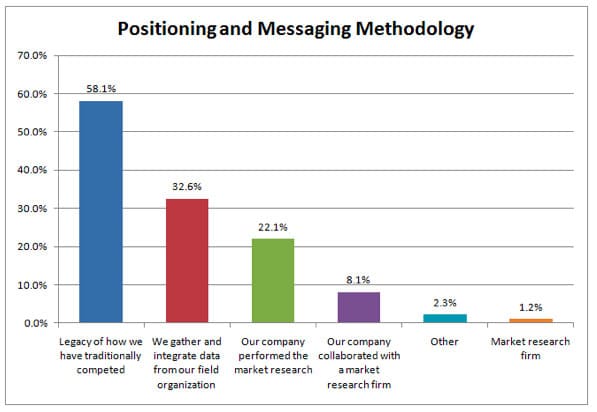

- Unclear understanding of value — Some distributors focus their message on benefits to the customer such as reduced inventory costs, increased productivity, or lower COGS. The most sophisticated of these distributors have created economic/ROI models that quantify the benefit to the customer. However, the vast majority of messaging from distributors focuses on features such as product selection, fast delivery, or quality products from leading brands. From our consulting experience, the companies whose messaging is primarily feature oriented have a limited understanding of the value they create. For many of these distributors, positioning and messaging are driven by longstanding perspectives on how to compete as shown in Figure 2. Updates are made based on feedback from sales and customer service employees. A small fraction of distributors perform systematic research through their marketing department (22 percent) or with a market research firm (8 percent) to understand what customers value.

It is also noteworthy that there is no gorilla in the market who positions as the price leader. Of course, many companies compete on price, some aggressively, to win deals. And, within niches, there are companies that position as the price leader. Yet there is no multi-billion dollar distributor who has positioned similarly to Southwest or to Walmart when it comes to no-frills and price. It would seem that there is an opportunity for a pure-play, single channel web presence in the distribution space. This pure-play web distributor would be obsessed with operational excellence at the expense of customer intimacy. The pure play distributor could be like Amazon: no customization, no handholding – just every product you want at a low price, with affordable overnight delivery when required. Or, the distributor could focus on a smaller set of SKU’s, much like Costco, except web only.

Messaging on Features of the Distributor Offering

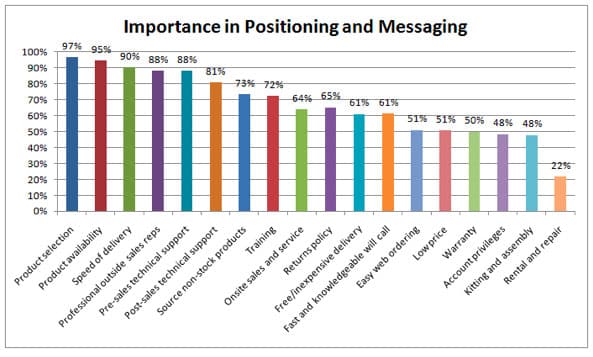

The messaging challenge for most distributors is that they tend to carry the same products as their competitors. As a result, it is virtually impossible to differentiate on products. So, most distributors normally develop messaging around other dimensions including features of their offering, quality processes, core values, and industry certifications. In the survey, we asked distributors to rate the importance in messaging of 18 features of their offering. Figure 3 shows the percentage of respondents who deemed the feature as either very important or important to their messaging. 95 percent or more of the respondents rated product selection and product availability as an important or very important part of their messaging. This was followed by roughly 90 percent who considered speed of delivery, professional sales reps, and pre-sales technical support to be an important part of their messaging. The next seven features of the offering led by post-sales technical support were considered by 60 to 80 percent to be important or very important in messaging. The bottom six features were considered by only 20 to 50 percent to be important in messaging.

The survey results suggest that there is a significant potential for distributors to have “me-too”, unprovocative messaging. Indeed, a review of 10 randomly selected websites, catalogs, or print flyers confirms that many distributors have similar messaging on features of the offering. Given the limited number of features that can be used as a basis for messaging and given that all but one of those features is used by at least 50 percent of the companies in the survey, how can a distributor differentiate through these features? Here are several ways that features can be used to create more compelling messaging:

- Analyze competitor messaging — The first step in creating messaging is to analyze all of the value claims made by you and your competitors. This involves reviewing print and electronic literature to gather all of the claims that they make about features and benefits. Claims that appear more frequently or more prominently, e.g. in a company tagline or homepage, show where the company’s messaging emphasis really is. Features that are not heavily emphasized may be good candidates for messaging, especially if they are also a relatively higher priority for the customers. The customer prioritization is determined in the next step.

- Determine the importance to customers — For this article we asked distributors how important they believe each feature is in their messaging. But, your job is to ask customers about the importance of the various features. At first glance, it might seem that they want it all. (Some do!) However, simple market research techniques will uncover the true priorities for your customers. The research will allow you to determine minimal requirements for the feature as well as the level at which you can differentiate through the feature. For example, almost all distributors boast about the number of products they carry. To be in a certain market segment may require 25,000 SKU’s. In that segment, 30,000 SKU’s could be enough that your customers truly can do one-stop shopping.

- Evaluate supplier capabilities — The third step is to understand how well each distributor provides on one or more features. For example, one company in a sector may be superb at training whereas the other companies have minimal or even no capability. This too can be determined through simple market research techniques if the capabilities have not been previously analyzed.

The goal of this process is to identify features or groups of features that are not heavily claimed by competitors that are also a high priority for your customers. That is the ideal outcome. In practice, it is necessary to make skillful tradeoffs in deriving messages. For example, it may turn out that there is a heavily claimed feature that is also very high priority for your customers where your company has superior performance. Even though it is heavily claimed, your superior performance combined with evidence in the form of testimonials, ratings, whitepapers, etc. may give you powerful bragging rights for that feature.

Conclusion

The set of features around which distributors can message is well known. Using this set of features, the marketing imperative for distributors of all sizes is to answer three questions:

- How do competitors position and message around those features?

- What priority do customers place on those features?

- How well do competitors deliver those features?

A clear answer to these questions is critical for developing clear, provocative, and differentiated positioning and messaging. Without a clear understanding, distributors are forced to rely only on intuition and gut-feel.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.