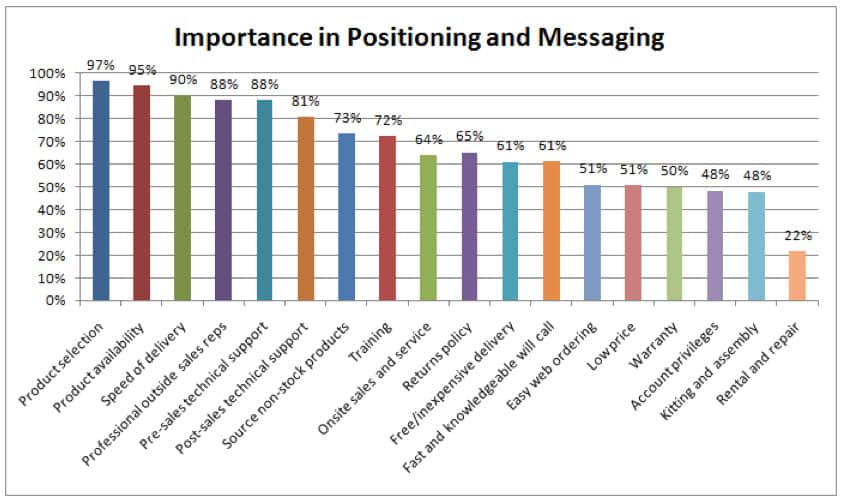

In a recent survey conducted with Modern Distribution Management, distributors ranked a list of attributes they believe are important in messaging (see Figure 1). But when we analyzed content on websites of large and mid-sized distributors, there was something missing. We found little to no messaging on several attributes that were considered important in the survey including professional outside sales reps, onsite sales and service, warranties, speed of delivery and the sourcing of non-stock products.

It may be that many distributors are just guessing when it comes to positioning and messaging. (In the survey, 70 percent of respondents said they used informal methods to develop messaging.) Their beliefs about what attributes are important to emphasize in messaging and positioning is based on scant market research. And even when they believe these attributes are important, only about half of these attributes become part of their messaging. For example, if you look at websites from many small and some mid-sized distributors, you will often see that they overemphasize how long they have been in business or focus too much on the history of the family business. To be sure, your customer wants to know that you have been around and that there is an interesting legacy. But the year of your incorporation should not make its way into the company tagline or slogan.

The problem is most pronounced among mid-sized and small distributors, but it is by no means limited to them. This article offers a systematic approach to describe and compare how distributors position and message. It relies on a semi-quantitative technique that we call “œmessage claims analysis.” We have used this message claims analysis successfully in marketing engagements and are currently using it to analyze more than 100 distributor websites. This process can also be applied to other marketing vehicles including print, social media, and mass media.

Message Claims Analysis Example

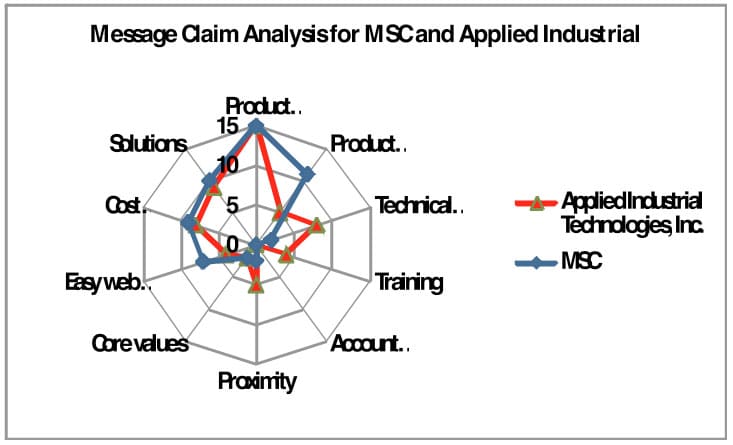

We start with a simple example to illustrate the concept of message claims analysis. The radar chart shown (Figure 2) quantify messaging claims made by large public distributors MSC Industrial Supply and Applied Industrial Technologies on their respective websites. By comparing these charts, one can see that both MSC and Applied place a similarly large emphasis on product selection, solutions and cost reduction. MSC also places particular emphasis on easy web ordering and product availability, whereas Applied highlights its technical expertise, training and proximity to customers. Neither company messages at all regarding customer account privileges.

To determine the score for each attribute in the message claims analysis, we review the distributor website looking for prominence (placement, size of font, etc.) and frequency of claims related to the attribute. As an example, for the product selection attribute, we look for the following types of claims:

- Number of SKUs

- Breadth of product categories

- Number of manufacturers

- Leading brand manufacturers

For each attribute, Distribution Strategy Group uses a set of keywords and phrases that we look for to determine messaging emphasis. Claims that appear on the home page are weighted more heavily than claims on the company page and claims on the product or other pages. Of course, if the claim is in the company slogan or tagline or it is part of the company logo, it has the highest weight of all. Claims from all of the pages reviewed are combined into a total score.

The analysis shows that Applied Industrial places greater emphasis on proximity to its customers than MSC as evidenced by the following quotations from their website:

MSC (About page): Our network of 4 regional Customer Fulfillment Centers and over 90 branches nationwide assures you same day shipping, at no extra cost, no matter where you’re located.

Applied Industrial (Company page): The Applied network of approximately 470 facilities, 4,600 employee-associates, seven strategic distribution centers, and more than 40 specialty repair and rebuild shops ensures that the products and support you need are always close by. With locations throughout the U.S., Puerto Rico, Mexico and Canada

Finding the White Space

By using messaging claims analysis, companies can develop better positioning and messaging. There are limits to quantitative techniques, but this method provides useful directional guidance.

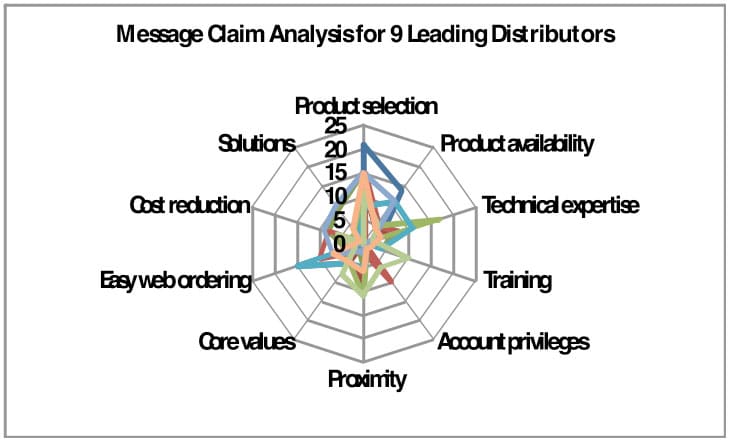

The first step in the process is to analyze the message claims for each attribute. On the radar graph below (figure 3, next page), we have overlaid message claims analyses for seven large distributors – Airgas, Anixter, Applied Industrial, Fastenal, Ferguson, Grainger, Graybar, MSC and Watsco – on 10 different attributes.

From a high level perspective, it is clear that most of these distributors place medium to heavy emphasis on product selection, technical expertise, solutions and cost reduction attributes. There is relatively less emphasis on product availability, web ordering, core values, account privileges, and training attributes — the white space on the radar graph.

This white space identifies areas of opportunity for distributors if they have the capabilities to take advantage of those opportunities and focus their messaging on those attributes.

The next step is to determine the customer and market requirements. Simple market research — both qualitative and quantitative — can be used to determine how important each attribute is to customers in the market. If the research shows the attribute has no importance to the marketplace, you may need to change your approach to how you message that attribute or abandon it all together.

As in the example provided, if the market research reveals that product availability is very important to the market, it could become a compelling basis for differentiation because it is not heavily claimed by most distributors. By contrast, differentiating on product selection will be difficult because most distributors identify that as a key attribute.

The third step is to assess the capabilities of the competitors in the market. For example, it may turn out that one distributor is more effective at reducing cost for its customers than other distributors in the sector. So, even though several distributors are messaging on cost reduction, the one distributor who is superior at cost reduction can make a unique claim about its capability.

Just claiming to be the superior provider of cost reduction solutions is not enough, however. Distributors who really wish to capitalize on superiority have to be able to quantify their claim as well; for example, “œWe reduce supply chain costs by 3 to 5 percent.” The objective is to find attributes with some combination of the following characteristics:

- Not heavily claimed by competitors

- Important to customers based on market research

- Unique or nearly unique capability of the distributor

There are several possible outcomes from doing this process:

- An attribute has all three characteristics — This is the best case and it rarely happens. When it does, it should be leveraged heavily for positioning and messaging.

- An attribute is not heavily claimed, and it is important, but not unique — In this case, it may be possible to combine the non-unique attribute with a unique attribute to form a new benefit. Or, it may point out a key capability that needs to be developed or improved to then have a dominant basis for positioning.

- An attribute is not heavily claimed, and it is unique, but not important — If the attribute really should be important to customers, but is not perceived as important, then it may be necessary to invest in educating the market on its importance. On the other hand, it may point out an area where a capability is over-developed relative to what the market requires. Scaling back that capability will reduce the cost-to-serve.

- An attribute is unique and it is important, but also heavily claimed — This is a great opportunity for marketing to communicate the unique capability. Customer proof of the unique capability in the form of testimonials, customer satisfaction surveys, ratings, analyst endorsement, etc., is the key to exploiting this advantage.

Distributors have enormous opportunity to improve messaging and positioning. The key to improving is to apply more formal techniques to understanding competitors’ messaging, market requirements and competitive capabilities.

The process described in this article is reliable in identifying the white space where it is possible to differentiate. Without investment in these techniques, many distributors will continue to suffer from “me-too” positioning and messaging.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.