Every incremental 1% improvement in retention pours profit to your bottom line.

Well-run companies know that customer retention is critical to long term success as a business. For some companies, an annual increase of 1% in customer retention over each of the next ten years results in 20% increase in annual earnings. Retention is powerful for several reasons:

- Lower acquisition costs – Less promotion is necessary and you can operate with a smaller sales force

- Long term base profits – The long term core customers provided a sustained profit on basic purchases

- Revenue growth – Long term customers spend more over time and their lifetime value increases

- Lower operating costs – Long term customers make fewer administrative and service demands.

- Customer referrals – Good customers will refer other good customers to you.

- Premium pricing – Satisfied customers are less price-sensitive.

Here is a simple measurement on customer retention: what percentage of customers who purchased from you last year also purchased from you this year? In general, as a distributor, if you have lower than 90% customer retention, then a retention campaign is probably going to provide higher return than a customer acquisition campaign.

Who is Defecting?

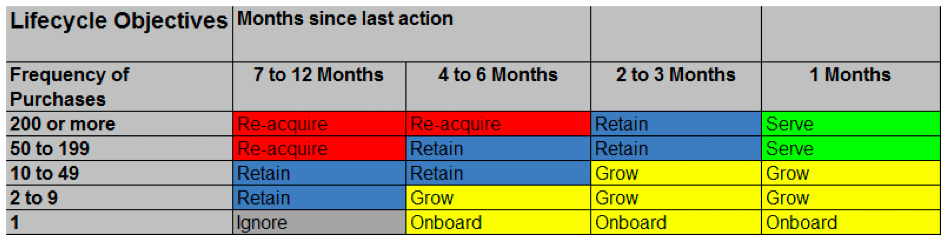

When you start to consider a retention program, there are key questions to ask before you embark. Who is defecting? Is it long time large customers? Midmarket customers? New customers? Price shoppers? Gathering information about the cause of defection is critical to any successful retention program. This information can be gathered from a variety of sources including your saleforce, surveys, customer product reviews, and structured interviews. While there may be a temptation to adjust prices to fix the problem, a calmer evaluation of the price and value mix is necessary to address the root cause of defection. RFM provides a straightforward approach for customer lifecycle management. As shown in Figure 3, each cell has a lifecycle objective. For the most current, high volume customers, the objective is to serve and maintain the account.

Lifecycle Management with RFM

Use Simple Analytics to Improve Retention

We have found that a simple behavioral segmentation technique is very powerful to understand which customers are at risk. The technique, call Recency-Frequency-Monetary (RFM) analysis, classifies customers according to how recently they have purchased and how many times they have purchased. As shown below, customers who have purchased in the last month are in good shape. However, customers who have purchased many times in the last year but who did not purchase in the last month are at risk of defecting (shown in the blue.) Smaller customers who purchase less frequently can go longer without purchasing before they are considered a risk to churn. Larger customers who have not purchased in 4 to 6 months have switched to another distributor. These customers are candidates for re-acquisition or re-activation.

Understanding the Root Cause of Defection

Once you have identified the customers who need active retention, it is important to understand why they are leaving. Typically it is some combination of value and price that is no longer working for them. Qualitative and quantitative research should be done with customers who have defected to understand the root causes. After you understand the root causes, you can implement an ongoing program to retain customers who are at risk.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.