If you give a salesperson 100 accounts to call on, odds are he or she will actively work the top 20 to 30, receive calls from the next 20 to 30 and ignore the remaining accounts. While this salesperson is busy maximizing his or her commission by focusing on the larger accounts, the company is missing significant opportunity in the smaller accounts. When these accounts are acquired and serviced through the proper channels, priced appropriately and managed well, they can increase the bottom line by several margin points. In turn, those margin points often lift net profit more than 50 percent.

At the same time, these smaller accounts cannot be serviced in the same way the largest accounts are if distributors wish to turn this kind of profit. But there are cost-effective ways to serve these small to mid-size customers:

- Sales and marketing channel alignment

- Price improvement

- Cost-to-serve reduction

The net effect of these approaches is to increase revenue and margin while reducing cost to serve such that small and midsize customer segments become attractive. This article provides an overview of these approaches.

Marketing and Sales Channel Alignment

For most distributors, the top 10 percent of customers represent 60 percent to 90 percent of that distributor’s revenue. This top decile is almost always managed by field sales representatives who rely on large accounts to make quota.

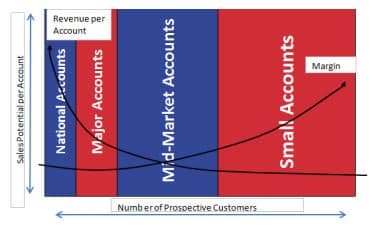

While there is substantial revenue in large accounts that form the top decile, mid-market and small accounts that make up the other 90 percent of accounts provide an opportunity to get higher gross margin percentage, as shown in Figure 1.

There are three main channels that are cost-effective for selling to mid-market and small accounts:

- E-commerce sites that provide easy navigation, good search and great product content.

- Proactive/outbound inside sales which involve account managers interacting almost exclusively by telephone rather than face-to-face.

- Direct response marketing programs including traditional print catalogs and flyers, as well as email marketing and marketing automation.

The proper development of any one of these channels can usually deliver 10 percent or more compounded revenue growth among small and mid-market customers over a two- to four-year period. The combination of these channels can achieve a compounded growth rate of 15 percent to 20 percent over a two- to four-year period. The financial impact to the entire company is 2 percent to 8 percent overall growth.

The expansion of sales channels provides for a proactive account management process for every single customer. Without proactive account management, small to mid-size customers are highly susceptible to defection – especially when competitors are prepared to give your customers the attention that you failed to provide. Our research shows that defection rates among customers who are managed by a sales rep are much lower than those with no account management process in place.

The development of small accounts can smooth lumpiness in revenue streams that results from a customer base that is too concentrated. It can also provide diversification and options for when the market shifts. Furthermore, the cultivation of these accounts will always reveal underserved accounts with huge potential that should be transferred to field sales.

Here are some symptoms that marketing and channel alignment could be right for you:

- Top revenue decile represents more than 75 percent of total revenue. This is evidence that your business is too concentrated in a small set of customers.

- High churn rate among lower decile customers suggests that those customers are getting better served by your competitors and moving on.

- Lumpy revenue can occur when your business is too dependent on large accounts or on accounts that have project revenue.

- Low wallet share in your small accounts indicates that the accounts are under-served by you.

- When field sales is the only or primary channel, then it is virtually guaranteed that small accounts are underserved by you.

Price Improvement

Many distributors subscribe to the myth that a principled price improvement initiative will result in losing key customers who are driven away by higher prices. In reality, small and mid-size customers are much less price sensitive than customers in the top revenue decile, particularly for non-core items they purchase infrequently.

Figure 2 plots the size of the customer on the X-axis versus the price they pay relative to list price on the Y-axis. The area highlighted below 1.0 on the Y-axis shows small customers who are purchasing at a significant discount. These discounts are invariably offered for no apparent reason other than force of habit and belief that it is necessary to win or maintain the business.

Some pricing solutions help customers achieve a margin improvement of 1 to 2 points. However, work by Strategic Pricing Associates has repeatedly shown that margin improvement of 2 to 4 points can be achieved by getting small customers to pay another 5 percent to 10 percent on non-core items. This additional margin drops right to the bottom line and often enhances profit by 25 percent to 50 percent.

Here are symptoms that price improvement could be right for you:

- A small spread between the average gross margin percentage of your top revenue decile customers and the rest of your customer base is strong evidence that you need price improvement. The spread should be at least 5 to 10 points and possibly more depending on your business.

- If your business culture tries to please the customer at any cost, then it is nearly certain that you are offering unwarranted discounts. It is essential to be able walk away from customers or transactions that are not good for your business.

- When your business is reacting to pricing moves in the market without any discipline, then price improvement is a great opportunity for you.

- If your value proposition looks like 80 percent of other distributors who tout selection, availability, delivery, and expertise then it means you need to better understand value and value selling, and how to create a differentiated value proposition.

- Frequently there is a vague objective to get more gross margin without a concrete plan to do so. This is yet another indication that price improvement will yield very good results.

Reduce Cost-to-Serve

Waypoint Analytics has detailed cost-to-serve information about the customers and transactions for several hundred distributors. A random sample of 87,000 customers from Waypoint revealed that unless a distributor has undertaken the process to reduce cost-to-serve its customers, it is likely that more than 70 percent of the customers are unprofitable. The business is sustained only by the 30 percent of customers who are profitable. The rest of the customers are breakeven or a drain.

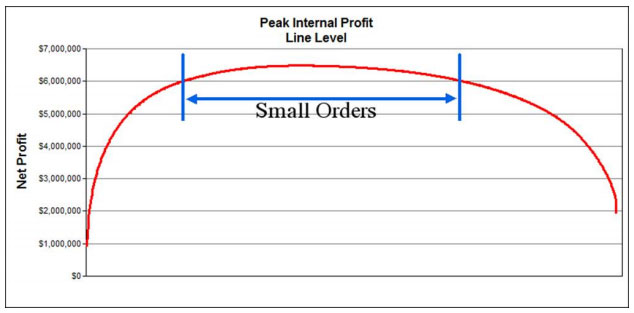

Measuring net profit, including cost-to-serve, at the customer level is a powerful starting point for assessing where customers fall on this spectrum. Plot the peak internal profit (PIP) by starting with the most profitable transaction and proceeding to the least profitable transaction as shown in Figure 3.

This curve, called a whale curve because of its shape, reaches a point of peak internal profit near the middle. Remaining unprofitable transactions will reduce the peak internal profit. For a typical wholesale distribution company, only 20 percent to 25 percent of their PIP goes to the bottom line

The different parts of the curve include:

- Core customers – transactions at the left of the curve that contribute significantly to net profit.

- Opportunistic customers – transactions slightly to the left of center that contribute somewhat to net profit.

- Marginal customers – transactions slightly to the right of center that subtracting somewhat from net profit.

- Service drain customers – transactions at the far right that are a significant drain on profit.

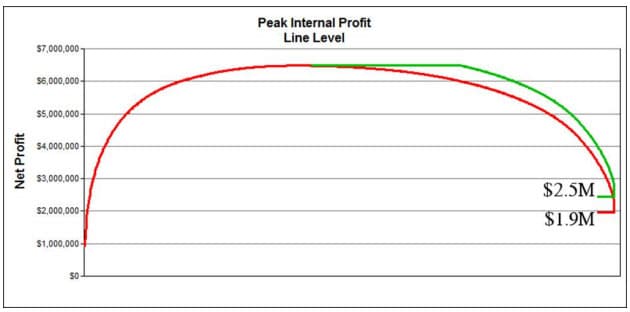

When processes are put in place to reduce the cost-to-serve for the small customers in the middle – the opportunistic and marginal customers – the PIP curve is transformed to what is shown in Figure 4. The key objective to reduce cost-to-serve is to increase the size of transactions and/or reduce the total number of transactions while keeping revenue constant. In this new curve, the marginal customers are now at breakeven. The result is a company that previously had $1.9 million net profit and now has $2.5 million net profit, a 30 percent gain. This is the conservative view, because increasing the profitability of the opportunistic customers or getting the marginal customers above breakeven will contribute even more to the bottom line.

While it is possible to create an in-house solution to reduce cost-to-serve, for most distributors, getting a third-party solution such as Waypoint Analytics or add-ons to an ERP system is more efficient and effective.

Here are symptoms that indicate that reducing cost-to-serve could be right for you:

- There are too many sales where expenses exceed gross profit.

- Nobody knows where profits are made or lost because it cannot be measured at the transaction or line item level.

- Growth and gains are weak because few companies manage deltas (profit improvements over time).

- Sales people and others are rewarded only on gross profit rather than net profit.

- There is nothing in the current systems or processes to detect, prevent or manage these problems.

Putting it All Together

Each of these approaches will help distributors make money with small customers; some of the most profitable distributors recognize the potential to make money with small customers by combining these approaches. When used alone, sales and marketing channel alignment can deliver 3 percent to 5 percent compound revenue growth over a several year period; price improvement can provide 2 points to 4 points of margin improvement, which flows through to the bottom line; and cost-to-serve reduction can improve the bottom line by 30 percent or more.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.