For most distributors, the top 10 percent of their customers represent 60 percent to 90 percent of that distributor’s revenue. Those customers are well served by field sales reps. The remaining 90 percent of the customers, often called house-accounts, have 10 percent to 40 percent of the total revenue. They are usually passively served through phone calls to customer service reps, branch visits, and e-commerce sites. However, there are two attributes of house accounts that make it worthwhile to actively cultivate them through the right sales and marketing channels:

- Because house accounts are mostly managed passively, even minimally active efforts to grow wallet-share in these accounts yields 5 percent annual growth. Managed properly, these house accounts can grow 10 percent or more annually with a significant contribution to overall company growth.

- In work we have done for distributors, house accounts often have 3 to 6 points higher margin than assigned accounts. For distributors who have implemented a price improvement program, the difference in margin percentage between assigned and house accounts can be as high as 10 points.

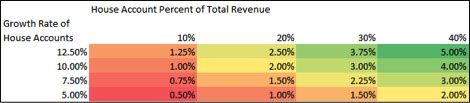

The opportunity for growth of house accounts depends heavily on how concentrated the revenue is among the assigned accounts. When it is more concentrated, even a large growth in the house accounts will have minimal affect on the total company revenue. Table 1 below shows two dimensions:

- Annual growth rate in revenue of the house accounts on the vertical axis.

- The percent of all revenue that comes from house accounts on the horizontal axis.

Each cell shows the revenue growth for the entire company based on revenue growth in the house accounts. At the lower left, a company with 10 percent of all revenue in house accounts that grows those accounts at 5 percent will only see a net half percent increase in company revenue. In the upper right, a company that grows house accounts at 12.5 percent and has house accounts that total 40 percent of the revenue will see a net increase of 5 percent company revenue.

Also, since the gross margin percentage for house accounts is higher than assigned accounts, the company gross profit grows slightly more than the company revenue as shown in Table 1.

Integrated Marketing

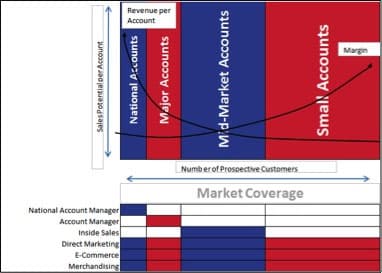

To cost effectively growth house accounts from 5 percent to 12.5 percent per year requires proper channel alignment. This means that there is a cost effective channel for acquiring and serving large, mid-size, and small customers. Figure 1 shows a sales and marketing map that works for well for house accounts including mid-market accounts and small accounts. For the mid-market accounts, the primary channel is inside sales, but is also supported by direct marketing and e-commerce. Small accounts are primarily handled through direct marketing and e-commerce.

The multi-channel approach works for house accounts with by keeping the distributor top of mind with its customers. The net result is increased order frequency and by increased average order value that provide 5 to 15 percent annual growth. The channels work together to drive branch traffic, calls, e-commerce, and email orders.

Inside Sales

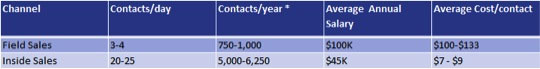

True inside salespeople are skilled hunters. They are motivated by capturing new accounts and rewarded accordingly. This is in contrast to customer service people who are better at gathering. When the proper structures are set up for proactive inside sales, distributors can cost effectively serve mid-market and smaller accounts in a manner that was previously infeasible. The economics of inside sales are shown below in Table 2. They can reach 20 to 25 customers per day at a much smaller cost per contact than field sales. Typical inside sales accounts spend $2500 to $15000 or even $25000 per year.

In research that we perform on behalf of distributors regarding channel preference, we find that there is increasing preference for inside sales because it takes 3 to 5 minutes instead of a 1 hour field sales visit. This is part of the larger trend toward more transactional transaction channels and vehicles.

Inside sales programs can be initiated with only a couple of sales people. Once the program is working well, it is easy to add new salespeople to the team. But keep in mind that a new inside sales person will take several months to reach 100 percent efficiency.

E-commerce

As noted in the 2014 MDM E-commerce survey, distributor e-commerce channels are maturing. The percentage of companies with at least 5 percent of total revenue going through the e-commerce channel is expected to grow by more than 25 percent. Distributors with at least 10 percent of total revenue from e-commerce is expected to double in 2014. Distributors who have successful e-commerce channels view it as a strategic opportunity rather than a tactical requirement dictated by their largest customers. They combine push and pull marketing techniques to get customers and prospects of all sizes to purchase from their e-commerce platform.

E-commerce is a great venue for customers of all sizes, but is particularly well suited to customers who purchase small amounts infrequently totaling less than a few thousand dollars per year. The low cost of creating and fulfilling an order reduces the cost to serve of the customer to a level where it is profitable for a distributor

Many distributors with more than $500 million in sales have achieved good levels of integration across the channel and have developed more sophisticated marketing effectiveness measurements. The imperative for distributors of all sizes is to create and continually refine multi-channel offerings.

Direct Marketing

Direct marketing includes both traditional print media such as catalogs, brochures and flyers as well digital marketing through email and marketing automation tools. Direct response marketing will not only increase sales of items featured in offers, but it also increases sales of other products. The rising tide lifts all boats.

The cost of direct marketing is usually less than $1 per contact, perhaps even a few cents per contact. Key with direct marketing is the regularity of touching the customer. It is well understood that multiple touches per customer are usually required before they are compelling to action.

Like the inside sales, there is no need to begin a direct marketing program with your entire customer base. The program should be large enough that you can have a test group and a control group to see what is working. For example, a print and digital flyer program would be tested with a control group that gets no correspondence, one that get just digital, one that gets just print, and one that receives both. This type of testing is powerful because many customer segments touch a variety of age groups who each have different communication preferences. Getting the right mix of digital and print will improve both effectiveness and efficiency of the campaign.

Conclusion

Aligning sales and marketing channels is one of the keys to making money with small customers. Your company can grow 3 to 5% per year just by actively cultivating small and mid-market accounts. Over time, your customers should be able to purchase from you how and when they want.

The sequencing of these programs is important. E-commerce will take about a year to launch and another year to have a smooth operation. If you want to start with one and only one new channel, we recommend either inside sales or direct marketing to our customers.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.