The Company is Doubling Down on B2B – and Likely Selling Its Retail Operations to Staples

ODP Goes on Offense with the Other Team’s Players

As many distributors wonder how to respond to the breathtaking growth of Amazon Business, Office Depot (official name, “The ODP Corporation”) has gone on the offensive by creating what looks like a direct competitor.

That’s not shocking news and Amazon Business certainly deserves some marketplace competition. The eyebrow-raising part is that ODP has hired a group of former Amazon Business executives to build the new company.

This is part of a larger strategy announced in an Aug. 24 press release that involves several major changes:

- ODP is splitting into two, independent, public companies: The ODP Corporation and Office Depot.

- Office Depot will include the company’s stores and retail ecommerce businesses and have a new CEO: Kevin Moffitt, currently the company’s Chief Retail Officer.

- Gerry Smith will remain as CEO of The ODP Corporation.

- The ODP Corporation will be made up of the company’s current contract sales channel, which will be called ODP Business Solutions and the “newly formed B2B digital platform technology business, which will be named Varis” (www.govaris.com).

- Varis and ODP Business Solutions will be operated as separate businesses, both owned by ODP.

Varis’s LinkedIn page says the company “is a digital commerce software-as-a-service and procurement company. On one modern and intuitive platform, business-to-business suppliers and buying organizations directly connect, transact and grow together.”

In other words, Varis is a marketplace. On its website, which is mostly a placeholder for now, Varis provides little information under its “About Us” tab except titles, bios and photos of some of its executives. But that small amount of info tells a big story.

Getting the Band Back Together

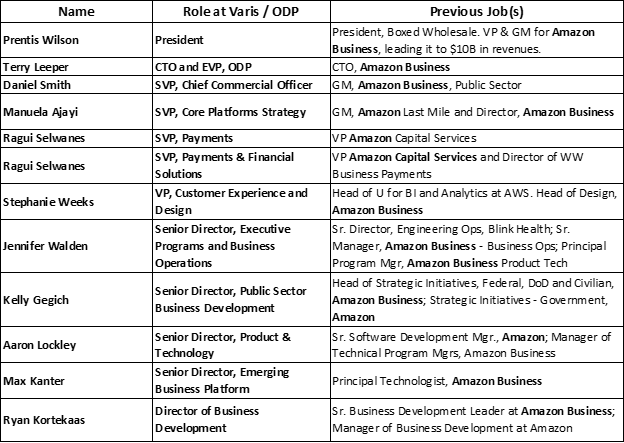

Digging into LinkedIn yielded a fascinating insight into the company’s leadership team – a large group of them came from Amazon and Amazon Business:

Terry Leeper joined ODP in July 2020 and serves as the CTO for the whole company. ODP announced they’d hired Prentis Wilson in February 2021, proclaiming that he’d “launched Amazon Business and grew it to over $10 billion in annual sales.” Of course, he didn’t do it alone and it looks like he got the band back together to see if they can do it again at ODP.

The company only lists 69 employees on LinkedIn, but they come from interesting backgrounds; besides Amazon, they have people who have worked at Microsoft, Home Depot, CDW, and of course, Office Depot, to name a few. I found none who’d worked at a traditional distributor – which is either a coincidence, an oversight, or a snub to the industry, depending on your point of view.

What’s Varis? And why is the website “GoVaris”?

The latter question is easy: www.varis.com is already owned – by Lee Varis, a “photographer, educator and digital imaging artist” who will soon suffer from millions of unwanted website visits from business buyers, companies interested in selling on Varis, and many analysts, journalists and other scoundrels like me.

The answer to the first question is more involved. Calling Varis a direct competitor to Amazon Business is partially speculation but it’s based on these facts:

- As noted, the leadership team.

- Office Depot acquired BuyerQuest and its sister company, PunchOut Catalogs, in February 2021. Both companies offer advanced B2B procurement solutions.

- BuyerQuest describes itself as the flagship product for Varis and lists three solutions on its website: Procure-to-pay, “Private Marketplace,” and “B2B Marketplace Hub.”

- BuyerQuest is on Varis’s homepage, and it builds marketplaces. Ergo, Varis will be a marketplace.

- The company has people responsible for recruiting vendors, partnerships, and other capabilities required to build a marketplace.

- In this second quarter 2021 earnings call, CEO Smith said that suppliers “recognize the expansive reaching capabilities of our new platform.”

Varis will no doubt be a sophisticated marketplace with strong eprocurement capabilities. For example, Amazon Business offers business customers capabilities that retail customers don’t need, such as:

- Multiple users and groups of buyers

- Product category access controls

- Products recommended by your company

- Approval workflows

- Spend analytics

- Electronic invoicing

- Pre-approved budgets to eliminate requisitions

- Consolidated PO purchases

- Seller certifications

- Tax exempt purchases

- Single sign-on

- Invoice reconciliation tools

- Purchasing contracts for GPOs

- Integration into about 80 eprocurement systems (including BuyerQuest…awkward!)

I expect that Varis is planning to offer most or all these capabilities, or even more, which is why ODP hired so many leaders from Amazon Business. This isn’t a simple consumer effort – it’s a full blown, big league, enterprise scale B2B marketplace. Like you-know-who.

Product Categories and Markets

While I couldn’t find any information about what kinds of products or markets Varis will ultimately focus on, I expect the marketplace to be similar to Amazon Business. That means products intended for office spaces, hospitality, institutions and government agencies. This is based on the legacy of Office Depot, as well as the expertise and history of team the company has recruited. So far, the only major marketplace focused “on the concrete” instead of “on the carpet” is Zoro, launched and operated by Grainger.

Genius Move or a Fool’s Errand?

ODP CEO Gerry Smith has been moving fast and making waves ever since he took the job in February 2017.

He stepped into a tough environment. ODP hit an all-time high share price of $420 in May 2006 and had lost more than 90% of its value by 2016. It wasn’t alone – the entire office supplies sector was hit: Between 2011 and 2016, for example, Staples went from $24B in revenues and almost a billion in net income to $18B in sales with a loss of $1.5B.

The likely culprit? Amazon. Between 2011 and 2016, Amazon’s sales grew from $48B to $136B. Many companies began making their simple purchases – like office supplies – on Amazon instead of from Staples, Office Depot, etc. This was probably the impetus for Amazon Business. (While there’s no doubt Prentis Wilson did a great job growing this business unit, it’s likely that some of Amazon Business’s $10B in revenue was originally inherited from the consumer side of the house.)

Office Depot launched its “Taking Care of Business” ad campaign in June of 2017 and Smith announced the company’s “Maximize B2B” restructuring plan in August 2020. These moves were outlined at the time in a great article by Mike Hockett at Industrial Distribution insightfully called, “Inside Office Depot’s Reinvention as a B2B Distributor.”

Meanwhile, at the depths of its struggles, Staples was bought by Sycamore Partners, a private equity group that specializes in retail. Statista estimates Staples’s sales have declined year after year to about $8.67B in 2020. The company is private now, so I don’t know if this is accurate, and I’m not a retail analyst, so Sycamore may have great plans for Staples that I don’t understand. But when Sycamore offered to buy Office Depot (yet again) in January 2021, I wasn’t at all surprised that ODP Chairman Joseph S. Vassalluzzo countered by offering to combine “our retail and consumer-facing ecommerce operations with Staples…including (the) potential sale of such assets by ODP.”

In other words, “You can have the retail; we’ll keep the B2B!” ODP subsequently announced it was divorcing into two different business units, thus making the retail partner single and ready to mingle with Staples.

Of course, ODP will have to wrangle with Amazon in either scenario: in retail with Amazon.com or B2B with Amazon Business. The benefits of the second choice are: 1. As tough as Amazon Business may be, it’s not nearly as dominant as its retail counterpart. 2. ODP has hired the team that built Amazon Business. That’s akin to Sycamore hiring Jeff Bezos to run its retail businesses.

So, while Gerry’s jury is out, he’s looking more like a genius than a fool to me. If he fails, he won’t be the first visionary leader to jump off a burning platform but get burned anyway (looking at you, Stephen Elop).

I believe Smith has chosen as the best strategic alternative available to him. I also think hiring the Amazon Business team was inspired, brilliant and something that several distributors could have done if they’d had the idea, the appetite for risk and the willingness to spend the money it’s going to take to fund their work.

Storm Clouds

It probably won’t surprise you to learn that ODP is not using Amazon (AWS) as its cloud platform. In February of this year, it announced that it had chosen the Microsoft Azure Platform. I wonder if Amazon Business will boot BuyerQuest from its partner network next.

We tried to reach out to Prentis Wilson before writing about Varis, but he didn’t respond. If we talk to him or Gerry Smith, we’ll provide an update on their progress. Stay tuned.

Throughout its history, Amazon has relentlessly gone on offense. It will be interesting to see if a well-capitalized competitor can put Amazon on defense – using not only the same playbook but some of the same players.

Ian Heller is the Founder and Chief Strategist for Distribution Strategy Group. He has more than 30 years of experience executing marketing and e-business strategy in the wholesale distribution industry, starting as a truck unloader at a Grainger branch while in college. He’s since held executive roles at GE Capital, Corporate Express, Newark Electronics and HD Supply. Ian has written and spoken extensively on the impact of digital disruption on distributors, and would love to start that conversation with you, your team or group. Reach out today at iheller@distributionstrategy.com.

2 thoughts on “Office Depot Hires the Amazon Business Team to Build a Rival Marketplace”

Pingback: ODP Corp., Office Depot’s Parent, Delays B2B-B2C Split | Distribution Strategy Group

Pingback: The ODP Corporation: A Bargain With Multiple Catalysts (NASDAQ:ODP) - LunaCrypto.us