Marketplaces are among the most successful business models of the modern era. From Amazon to Google to Grainger’s Zoro, there’s clearly good money in the marketplace. Businesses that can establish themselves as the gateway between buyers and sellers don’t just make billions. They also gain a highly defensible position as a critical link in the supply chain.

Today, many distributors want to re-establish themselves as marketplaces. But, becoming the permanent and profitable link between manufacturers and buyers is easier said than done. In this article, I’ll explain how distributors can create winning marketplaces by mastering three strategies: effective product sourcing, AI-enhanced product discoverability and a monopoly on customer attention.

Effective Product Sourcing

The first, and perhaps most obvious, element of a good marketplace is product availability. The No. 1 reason why customers choose Amazon is that it has “the best selection of products,” according to survey data from digital agency adlucent. Given that Amazon is purported to carry more than 350 million SKUs, this seems like something of an understatement.

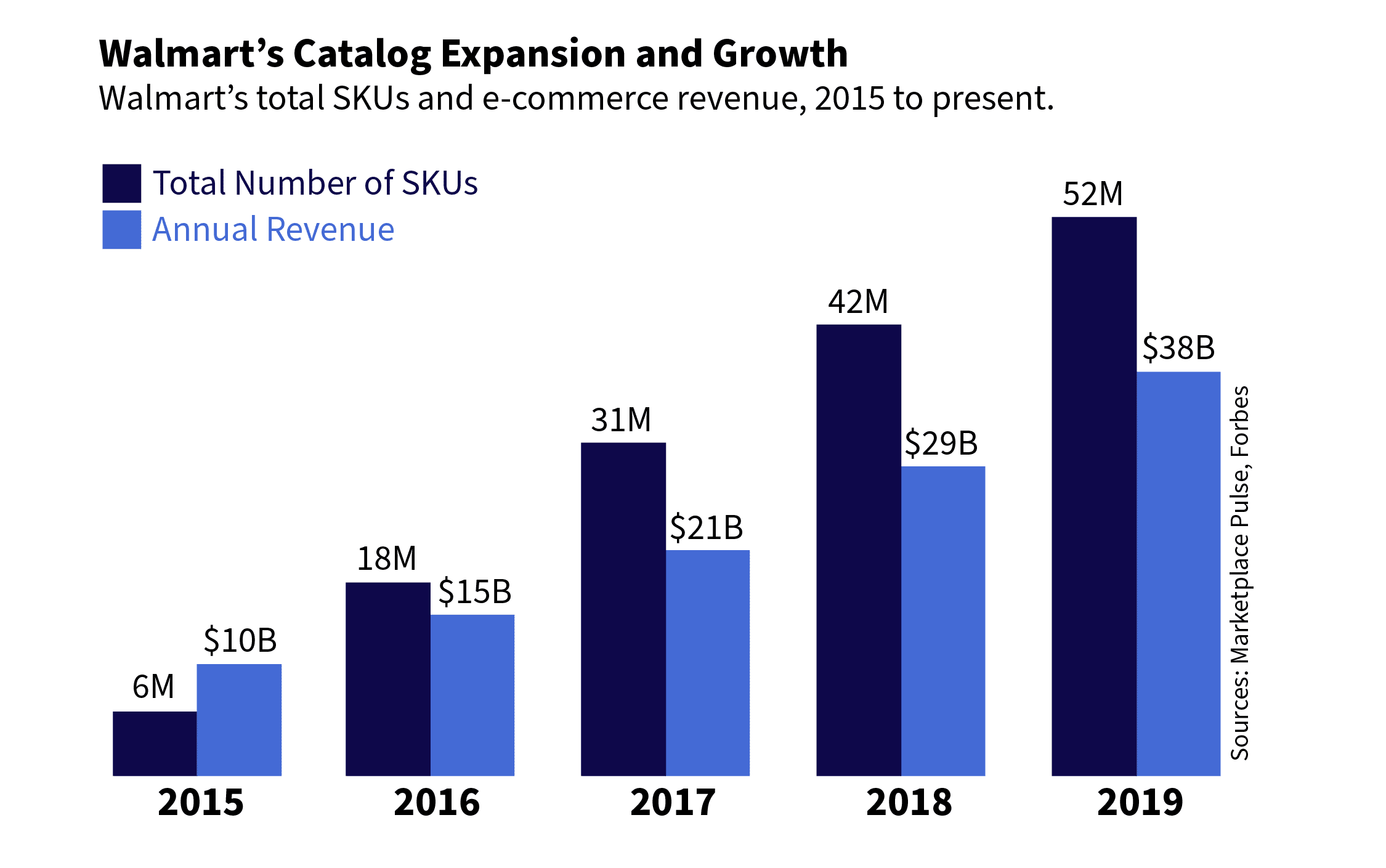

Amazon knows that customers prefer to buy from one-stop-shop marketplaces. But, so do Amazon’s competitors. Over the past few years, Walmart has aggressively pursued catalog expansion and started offering products from millions of third-party sellers. In the past four years alone, Walmart has increased its total number of SKUs by roughly 8x. In that same time period, the superstore’s e-commerce revenue grew by roughly 4x.

Of course, there are other reasons behind Walmart’s recent e-commerce surge. But its catalog expansion can certainly not be overlooked.

Some distributors are even starting to drive catalog expansion with third-party vendors, as well. Grainger’s marketplace Zoro, for example, was said to have about 3 million SKUs as of late 2019. By 2024, however, Zoro intends for that number to skyrocket to 13 million. After all, selling more products to more customers starts with having more to sell.

AI-Enhanced Product Discovery

Just because you offer more products doesn’t mean that customers are going to buy them. As your product offerings grow, it becomes harder and harder for customers to naturally find the items they are looking for. That’s why catalog expansions must be accompanied by AI tools that make effective product discovery possible.

AI-based product recommendations are a great place to start. These tools use tons of customer data and advanced predictive algorithms to forecast who is most likely to buy what and when. AI can then be used to take automated actions that pitch the right items at the right times.

In 2013, McKinsey reported that AI recommendations accounted for 35% of the items bought on Amazon, and 75% of the shows watched on Netflix. Today, these numbers have likely increased even further. This proves that companies with large catalogs can confidently rely on AI to pair the right customers with any number of products.

AI-enhanced search engines can also make large catalogs much more profitable. Amazon spends a lot of time and effort in improving its search function so that when customers search for a product they get the most relevant possible results. As a result, Amazon converts roughly 4x more customer searches into sales than competitors like Walmart and eBay do.

Distributors do not need to build AI tools on their own. Instead, they can fast-track tech initiatives with the help of AI vendors. Either way, having technology that helps with customer product discovery is a must; expanded catalogs are meant to be a benefit for customers, not a navigation challenge.

Read more: Should you build your own marketplace?

A Monopoly on Customer Attention

More products and better product discovery tools lead to customer loyalty, and this itself is the best defense strategy there is. Here’s what I mean:

Today, some 88% of consumers report that they prefer to shop on Amazon over other sites. This means that retailers have no choice but to list their products on Amazon. These expansive product listings, coupled with Amazon’s AI-enhanced discovery tools, further enhance the customer experience, which makes it even more necessary for vendors to list with Amazon. As this mutually reinforcing cycle of marketplace dependence plays out, Amazon only attracts more customers and more vendors.

As of now, distributors still have plenty of opportunity to create successful marketplaces. However, if distributors wait much longer, they will risk losing customer attention, and thus the ability to command manufacturer loyalty. The best thing that distributors can do today is to start investing in all three pillars of the marketplace.

Distributors already have customer attention but can further increase loyalty and interest through digital marketing. Distributors also tend to have large catalogs, but there is clearly room to increase these through third-party vendors or new manufacturer relationships. Finally, distributors must invest in AI solutions quickly to bring about a winning marketplace. For distributors, the choice is not customer attention or AI tools or a bigger catalog. It’s everything or nothing.

Benj Cohen founded Proton.ai, an AI-powered CRM for distributors. His company’s mission is to help distributors harness cutting-edge artificial intelligence (AI) to drive increased sales. Benj learned about distribution firsthand at Benco Dental, a family business started by his great grandfather. He graduated Harvard University with a degree in Applied Math, and speaks regularly at industry events on the benefits of AI for distributors. Benj has been featured in trade publications including MDM, Industrial Distribution, and Industrial Supply Magazine. His company, Proton.ai, announced a $20 million Series A round of funding in 2022, led by Felicis Ventures. In 2023, Benj was recognized in Forbes 30 Under 30 – the first leader in distribution to receive such recognition.

1 thought on “The 3 Ingredients You Need to Build a Successful Marketplace”

How do you differentiate a distributor marketplace with true 3rd party sellers (like walmart and Amazon) from current distributor websites that already have drop ship for non-stocked items from their suppliers.