This article, based on a survey conducted by Distribution Strategy Group, looked at how distributors are dealing with the online giant and found that some are trying to beat Bezos & Co. while others are joining them.

Amazon is a machine. The online retail juggernaut has recently churned out the world’s richest man and, its tendrils of modernization are slowly reaching into every physical industry in the world. In distribution, some know this, some don’t. Distribution Strategy Group looked to see what distributors think about how Amazon Business is affecting their business.

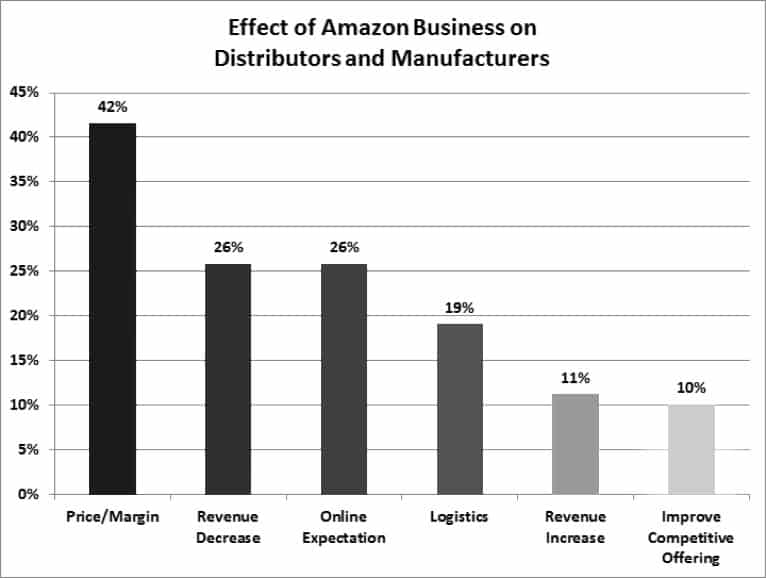

A summary of the different responses is shown below in Figure 1. While we expected that respondents would indicate margin pressure and loss of business, we were surprised by the number of respondents who are benefitting through Amazon. The remainder of this article gives details on what we learned.

Figure 1 – Effect of Amazon Business

Unknown or no effect yet from Amazon

More than half of respondents said that Amazon has affected little or none of their business. Within this denomination of respondents, there were several groups. One distributor said, “Amazon has had little impact on our business – yet. Their lack of understanding of the customers’ demands has made our value proposition look better to many customers.”

This comment is representative of distributors who pride themselves on knowing their customers, and being a more personable alternative to gargantuan corporations that might not be nimble enough to truly understand their business partners. Similarly, another distributor said “We’ve not been affected. We focus more on value add and less on transactional business.” In both cases, the distributors believe they offer something Amazon cannot and are therefore safe.

Another perspective of survey respondents is that the Amazon effect is hard to measure because it’s difficult to gauge the business you aren’t getting. You can learn things anecdotally, but actual numerical revenue or profit loss values in light of Amazon are difficult to pinpoint. This outlook was expressed by one respondent from a $100 million-plus HVACR distributor: “I would argue that we don’t know the impact right now. The economy is doing so well that we are experiencing double-digit growth in most of our states regardless of Amazon.”

Positive effects as result of Amazon

Some companies said that Amazon was helping their business. Slightly more than 10 percent of the respondents are distributors who are selling via Amazon and are benefiting from revenue growth. One very large industrial product distributor stated simply “We’ve grown with Amazon the past several years.” Another small distributor mentioned they are “Selling more through Amazon every year.”

Other distributors are seeing their competitive offering becoming more desirable as an effect of Amazon. A manufacturer said, “Amazon has been very visible, and our network has become very focused on what they do.” The company benefited from improvements in its competitive offering. The threat of Amazon stimulated the company to improve its own customer experience via e-commerce, a sentiment expressed by several distributors. Amazon is raising the bar by setting expectations for much greater product availability, delivery time and selection. Distributors must up the ante to keep pace.

Negative Effects as a Result of Amazon

A new 800-pound gorilla that continually invests in its business and isn’t afraid of failing will obviously have negative effects.

Some distributors are feeling negative pressure from Amazon, especially with regard to price and margin. Amazon has repeatedly entered markets and offered highly competitive pricing relative to the other businesses already in the market, and distributors and manufacturers across the world are coping with Amazon’s ability to drive down price and margin, particularly on commodities.

A small plumbing distributor said, “It’s becoming a problem. It’s taking away our opportunity to make a profit.” Based on our own research in B2B shopping and buying we estimate that distributors could be seeing a 2-3 percent loss in margin in certain categories.

Amazon is taking share in “Price Only” customers. For those customers who care little about anything other than a price tag, Amazon is taking orders hand over fist. One very small distributor noted “The biggest effect is that they raise the risk that the traditional distributor gets used for training/information/problem solving, and then we are expected to provide all of this for Amazon’s prices. In the end, surviving against this threat will make us better distributors because it will re-emphasize the importance of being paid for the value we provide.”

Commodities that can be delivered by common carrier are particularly at risk. Amazon has made billions selling and delivering via common carrier. Amazon’s logistic efficiency and low prices have left distributors wondering what role commodity products will have in the future, even if they don’t feel the effect yet. A very small distributor summed this up well saying, “It’s reduced opportunities to sell smaller, lower cost commodity products.”

One of the biggest negative effects of Amazon’s entry into all realms of business is how they’ve raised the bar in online retail experience. It’s so easy to buy on Amazon, as most of the site’s users would argue, and this translates from the consumer side to the business side. Buying wholesale is now as efficient and easy as buying retail. Very few distributors, if any, can compete head-to-head in terms of online experience, and while they are expected to try to match the service few are going to reach that goal. “Amazon has forced us to sharpen our web experience and web SEO skill set,” according to one survey respondent.

Selection, delivery time, and product availability are huge advantages for Amazon, which is rumored to have 500 million SKUs. No other business in the world can match that. It now has same-day delivery for some products, while next-day and two-day have become very standard. Amazon is making an incredible proposition here by offering every product you want, as soon as you want it, for cheaper than everyone else.

That’s hard to match, but savvy distributors can find ways to compete by emphasizing value add and focus intently on customer needs.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.