Key trends

- E-commerce revenue as a percent of overall revenue is rising, yet growth is slow

- Lower barrier to entry for small companies

- Key objectives are branding, growing revenue with new customers, and improving website usability

- Grainger is still overwhelmingly considered the best website by other distributors

- Respondents express mixed satisfaction with much of the B2B functionality on their own e-commerce sites

- Marketing efforts are rudimentary and siloed for many distributors

Information in this presentation is from two surveys:

– February 2015, State of Distributor E-Commerce survey of more than 400 distributors conducted with Modern Distribution Management.

– Ongoing Shopping and Buying survey of several thousand end users from multiple distributors.

Best Competitor Website

- Overwhelmingly, Grainger is named by competitors as having the best website for the fourth year.

- McMaster-Carr was a distant second.

- Nobody else was even close.

- Grainger added several hundred people to its e-commerce initiative in 2014.

Revenue and Growth

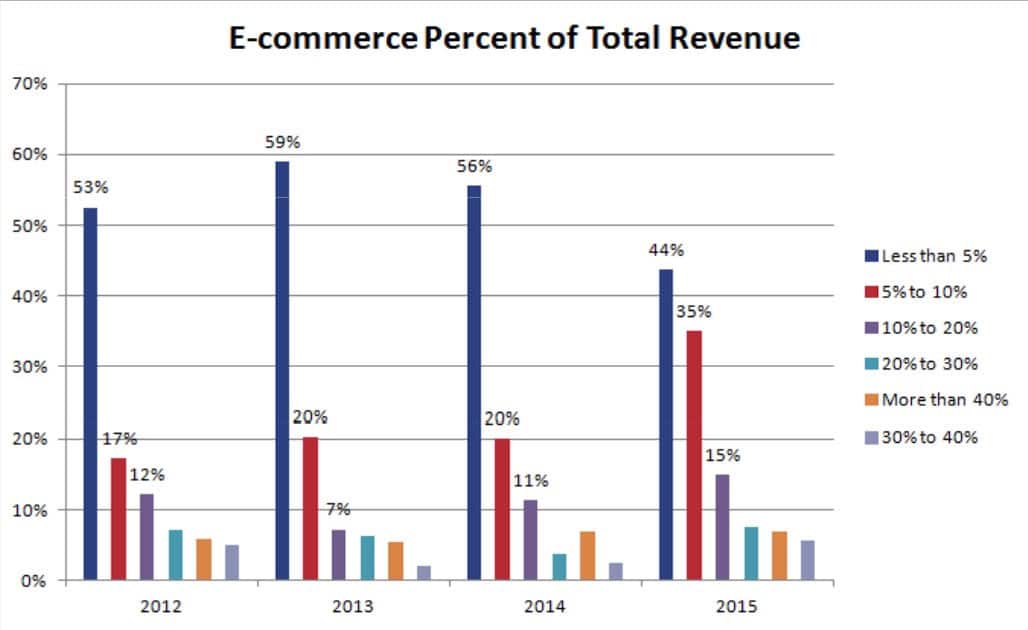

Stages

- Nascent: less than 5% e-commerce revenue

- Growth: 5% to 10% e-commerce revenue

- Mature: 10% or more e-commerce revenue

E-Commerce Revenue – 2012-2015

- 2013 ‐ Increase of nascent and growth stage companies.

- 2014 – Increase of mature stage companies.

- 2015 ‐ Projected:

- 75% increase in growth stage companies.

- 40% increase in mature companies.

Perspectives on E-Commerce Growth

- Nascent stage – 3 to 5 years.

– Development – Half year to 1 year.

– Working out operational kinks – 1 year.

– Getting to 5% of total revenue – 2 to 3 years. - Growth Stage – 2 to 4 years.

– Continued test and refinement (CRO – conversion rate optimization).

– Content development for self-service and SEO.

– E-procurement build out, if needed.

– Strong multi-channel marketing to support and promote online channel.

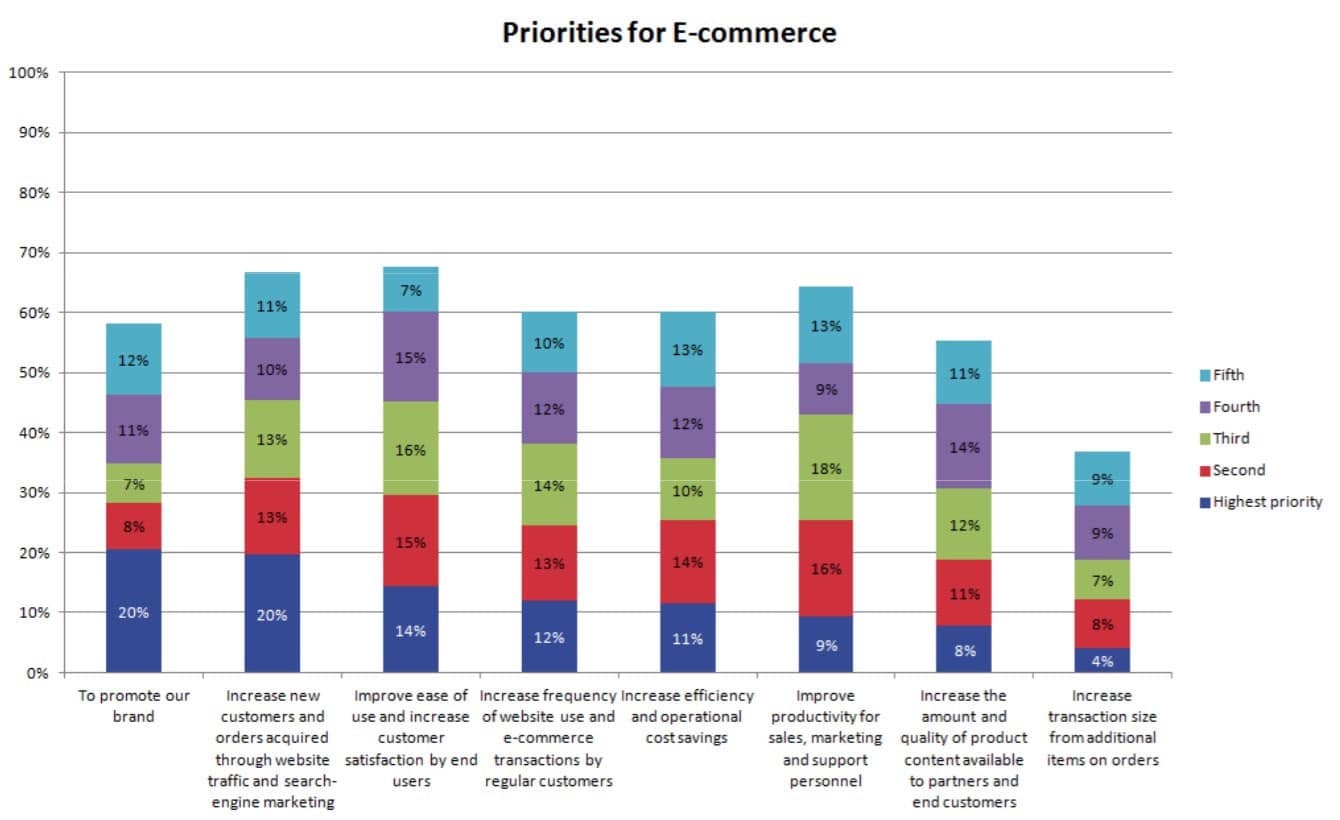

Priorities

Top priorities are:

- New customers

- Promote brand

- Ease of use

Priorities reflect the growth stage of e‐commerce in which the priority is to get revenue with new customers with a better user experience.

E-Commerce Leadership

Among respondents with nascent stage e‐commerce programs, only half have dedicated leadership vs. 70% who in growth or mature stage.

(Data from 2014 survey.)

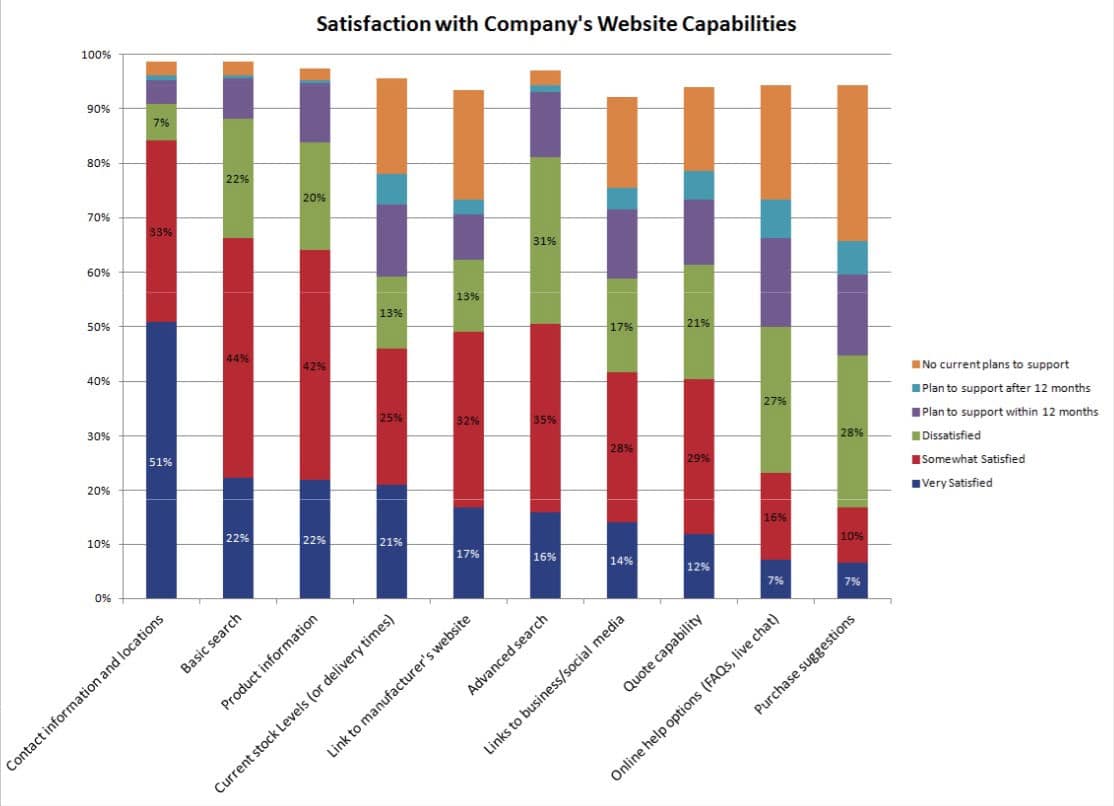

Capabilities

Respondents are satisfied with the basic functionality:

- Contact information

- Product information

- Basic search

For key capabilities that support self‐service and increase conversion, satisfaction is low:

- Quote

- Live chat

- Purchase suggestions

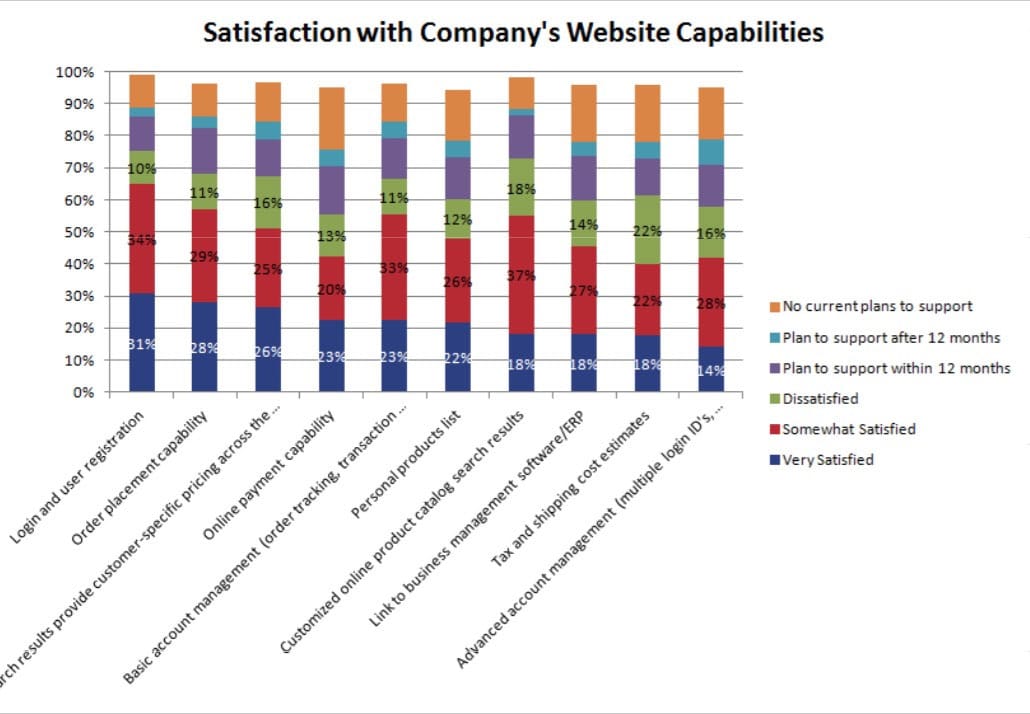

Respondents have high satisfaction with:

- Login

- Order placement

- Search results with customer‐specific pricing

- Basic account management

Except for Tax and Shipping, other functions are B2B that have mixed or low satisfaction.

End users have higher expectation for Tax and Shipping that is derived from the B2C world.

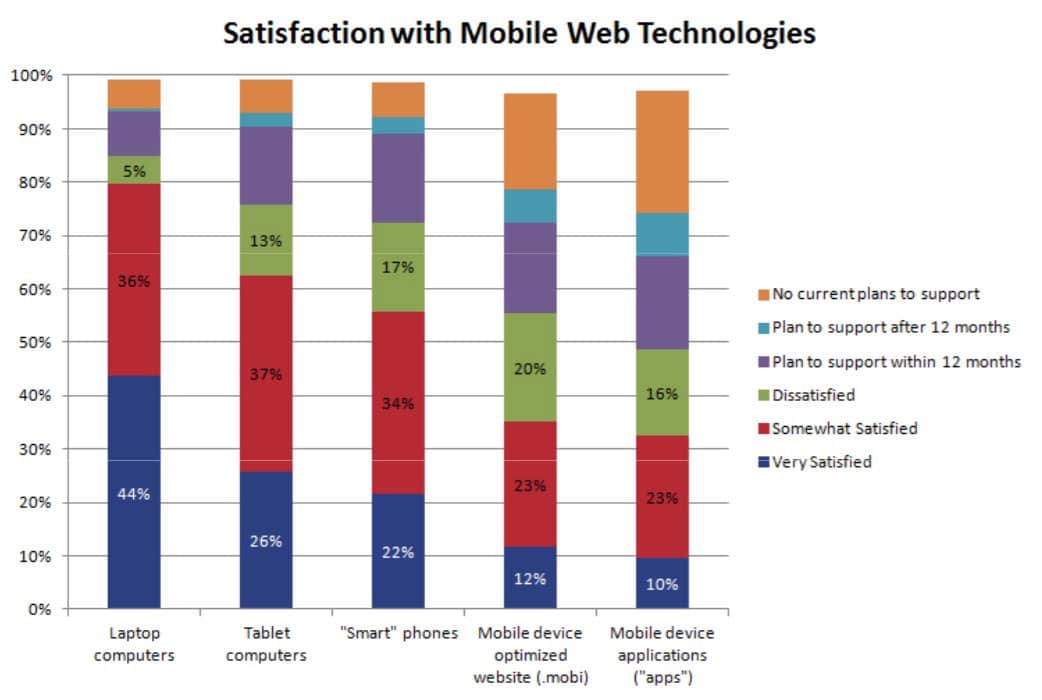

Mobile

Biggest changes from 2014 are increased satisfaction with:

- Mobi

- Mobile apps

Satisfaction with support for tablet and smart phones remained about the same as 2014.

From Shopping and Buying, survey 35% consider Tablet and more than 45% consider Smart Phone important within the next year.

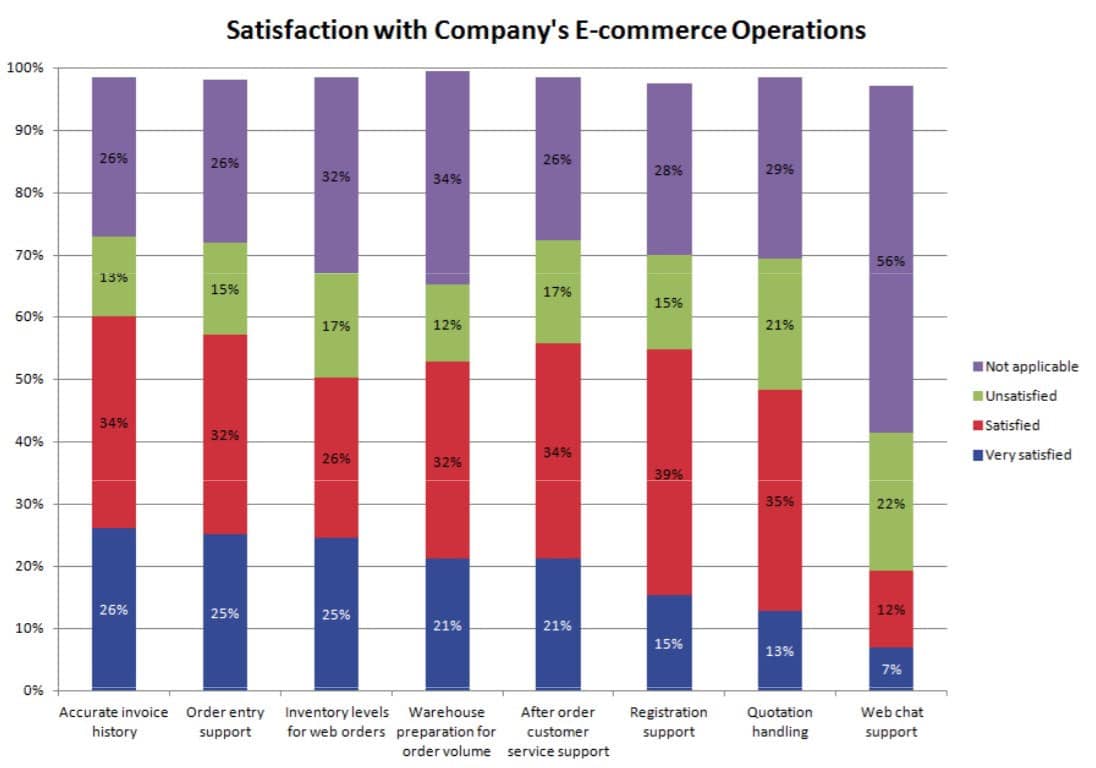

Operations

- Fulfillment: slightly lower satisfaction with warehouse and inventory levels.

- Quotation handling: still a big concern with nearly 20% unsatisfied.

- Order handling: Good except chat is underutilized.

Summary

- There is maturation from last year in overall capabilities.

- Growth areas for many distributors are in B2B functionality.

- Specific functionality requirements should be derived from market research with your customer base.

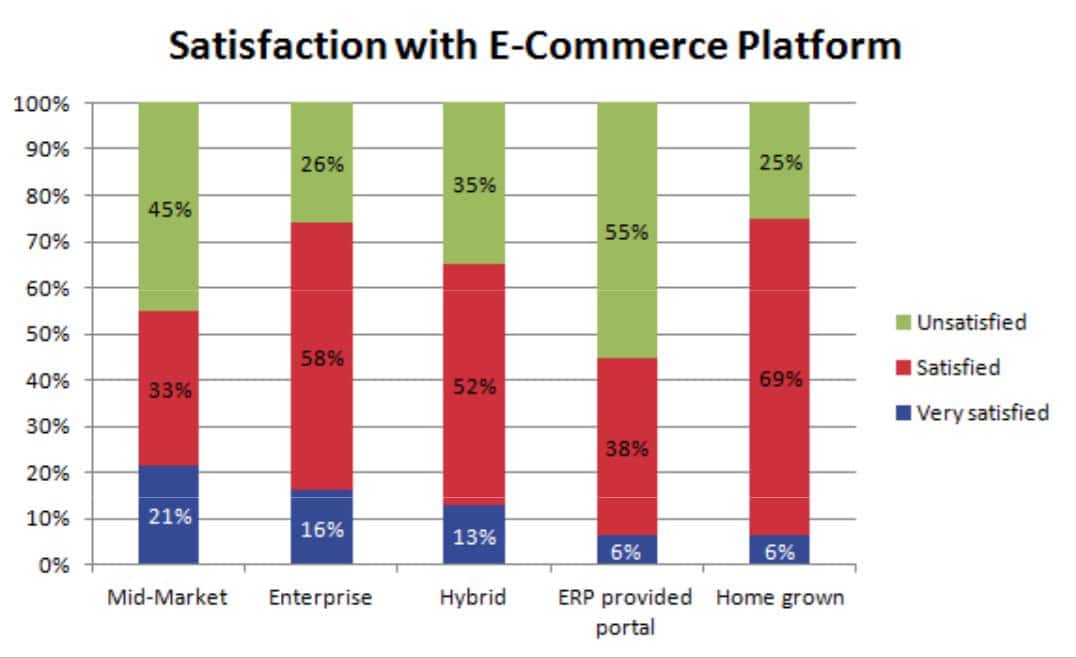

Platform

Overall comparable satisfaction between Enterprise e‐commerce at 74% and Homegrown at 75%. But, Enterprise has a much high percentage of Very satisfied, 16% vs. 6%. Companies with nascent e‐ commerce capability are the least satisfied with their e‐commerce platform.

| Focus | Tactical | Strategic |

|---|---|---|

| Platform | Mid-Market/ERP Portal | Enterprise |

| Leadership | IT | Marketing |

| Measurement | TCO | ROI or ROMI |

Marketing

Driving E-Commerce Demand

- Sales rep and CSR’s are highly effective at driving demand.

- Email marketing, catalog, and SEO are most effective and highest spend.

- Both paid search and marketing automation are underutilized in distribution relative to other industries.

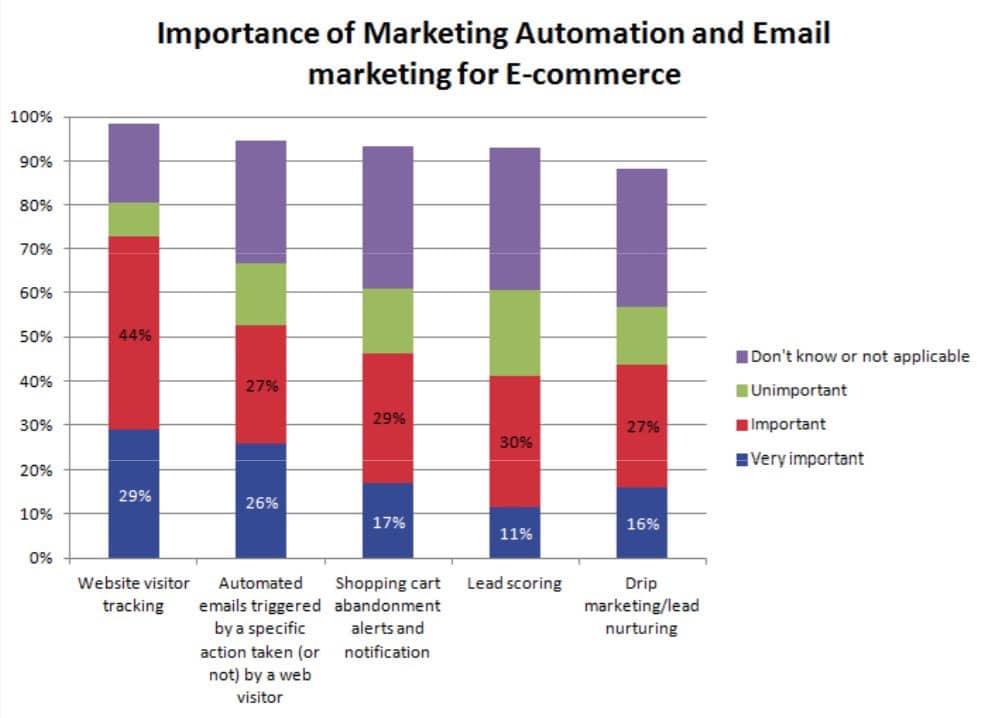

Marketing Automation and Email Marketing

Many distributors use email marketing to promote products, special, and branch events.

There is limited awareness among distributors about marketing automation and how it differs from email marketing.

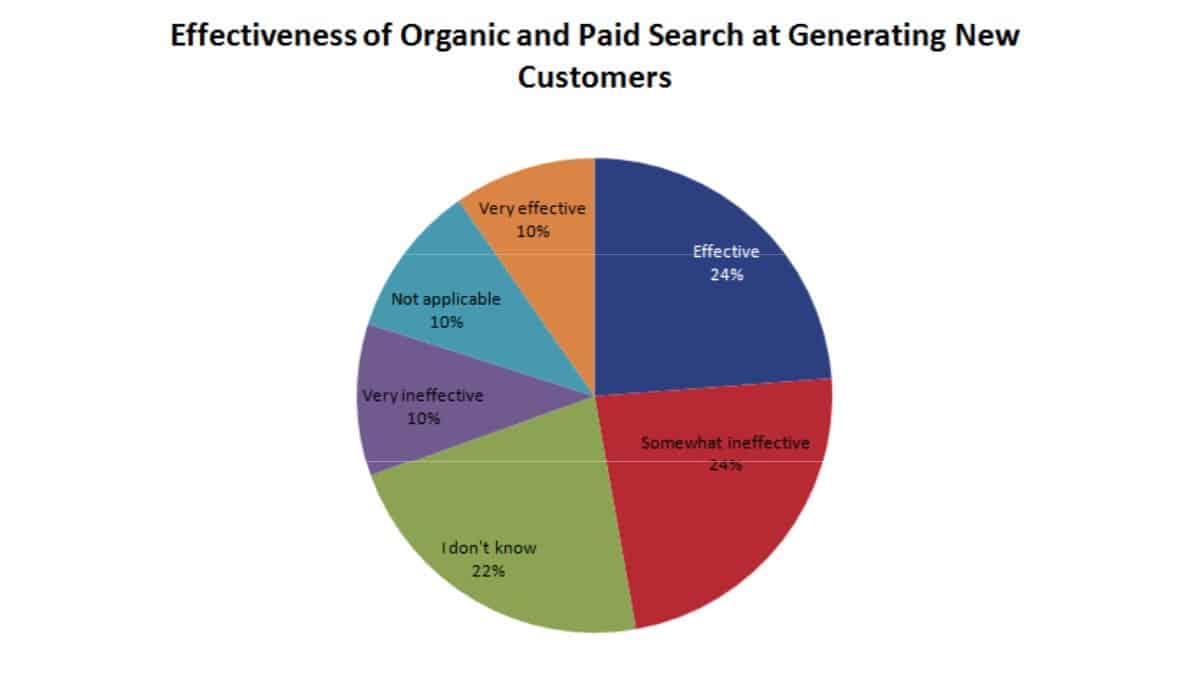

Search Marketing

Many distributors start with search marketing as the primary or only means to drive traffic and generate demand. Yet, only one third of respondents consider search marketing effective for customer acquisition.

Our research of survey respondents shows:

- Improving organic search is low hanging fruit and should be done.

- Less than 20% are using paid search and few effectively.

Integrated Marketing

The Problem

- The way customers want to shop and buy is shifting toward more efficient vehicles and mechanisms.

- Most distributors still have a field sales centric model even if they have begun a multi-channel offering.

- National competitors who have effective multi-channel offerings are taking market share from smaller competitors.

- Distributors understand they need some multi-channel offering, but are uncertain about the timing and requirements both within and beyond e-commerce.

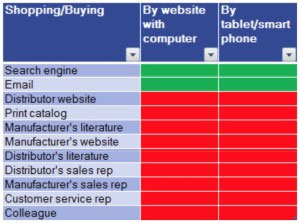

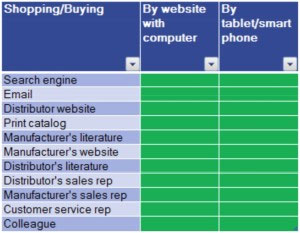

Broad Shopping Trends

- 74% of business-to-business buyers said they research half or more of their work purchases online before buying. —Forrester

- 46% of potential buyers researching b-to-b products are millennials today, up from 27% in 2012. —Google, Millward-Brown

Distribution Shopping Trends

Top three methods from Shopping and Buying Survey:

- Manufacturer website

- Search–on the rise significantly

- Distributor website

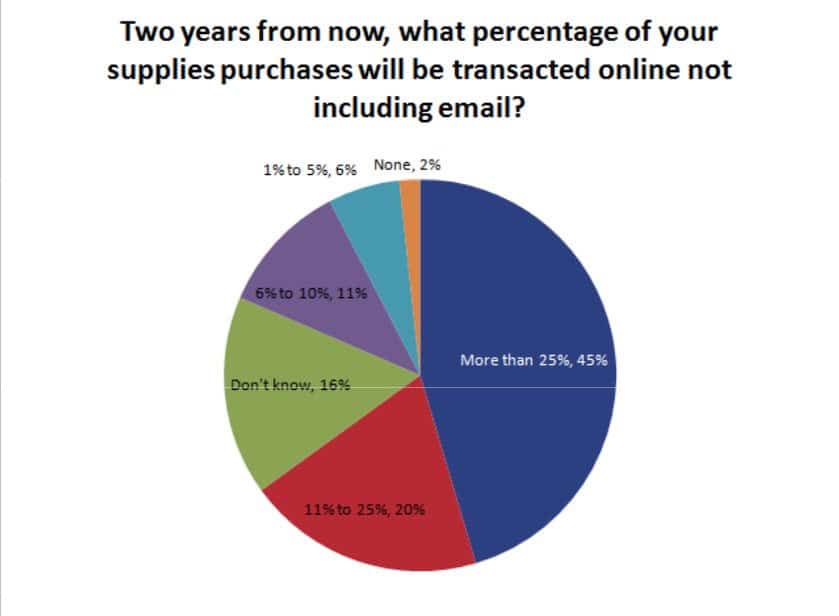

Future Online Transactions for One Distributor

In 2 years:

- Nearly half believe that 25% or more of transactions will be online.

- One fifth believe that 11% to 25% of transactions will be online.

Predictions about future behavior should be treated as directional rather than precise.

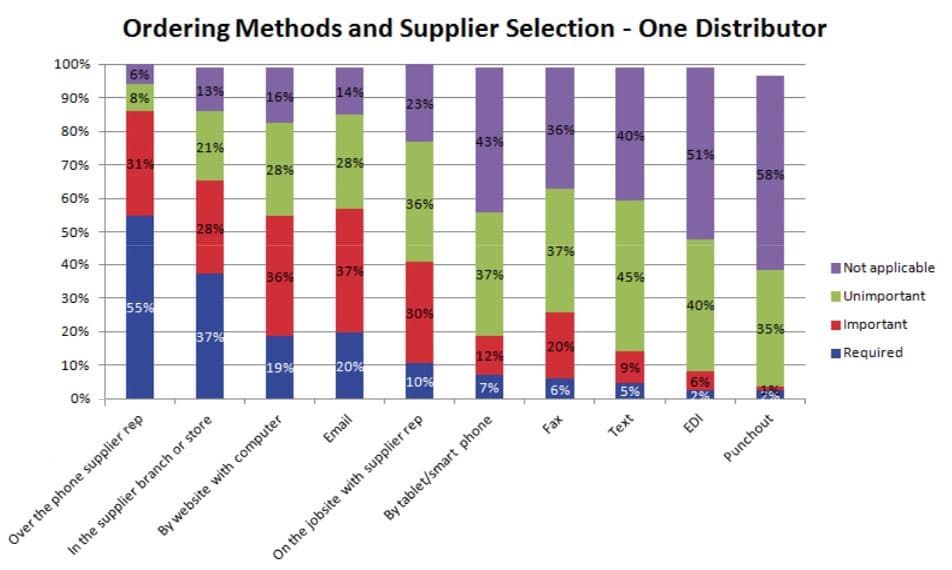

Ordering Methods

In Shopping and Buying survey, the most essential ordering methods are:

- Over the phone

- By website.

Face to face, in the branch or at the job site are declining. Individual mileage does vary: For one distributor’s customers, ordering with personal interaction (phone or face to face) is a much more significant requirement than electronic (email or web.)

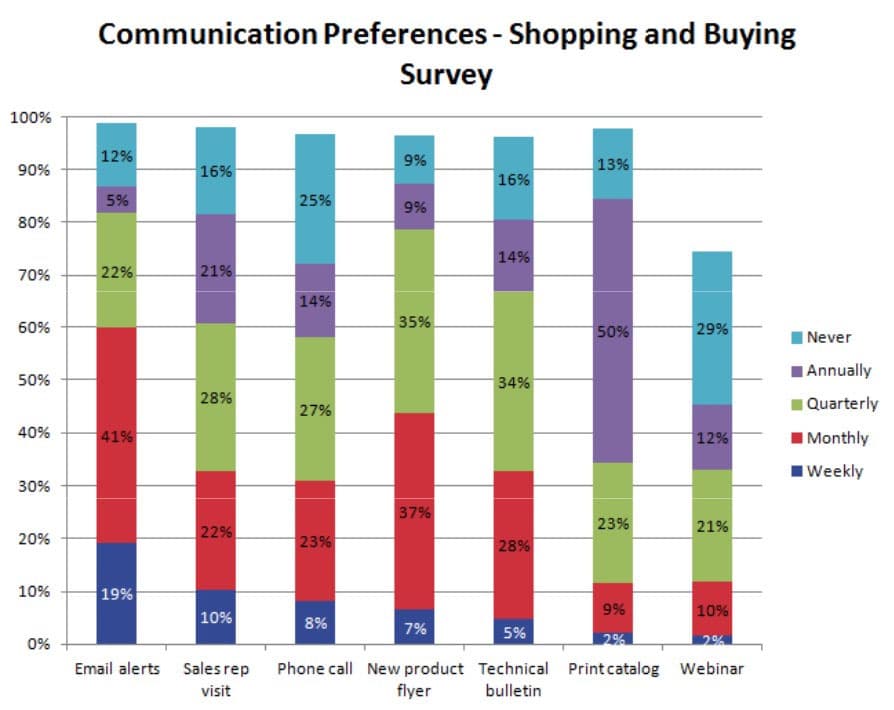

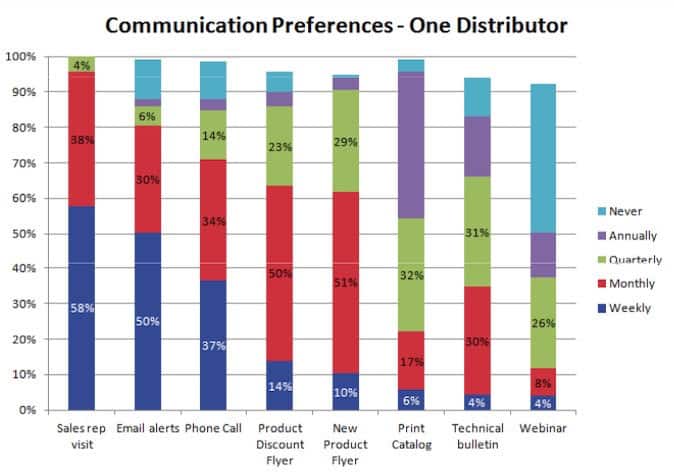

Communicating with Customers

Customers want to hear from you more than you know and in more ways than you suspect.

- 16% of customers NEVER want a sales rep visit and 21% want a visit once per year.

- 84% want a catalog at least one a year.

- 60% will get email alerts at least monthly.

Individual mileage does vary:

- 16% of customers NEVER want a sales rep visit and 21% want a visit once per year in the Shopping and Buying survey.

For this distributor:

- 96% want a sales rep visit weekly or monthly.

- 95% want a catalog at least once per year.

- 80% will receive email alerts at least monthly.

Respondents from this customer base differ in important ways from others in the Shopping and Buying survey.

Limited View of E-Commerce Marketing

Many distributors have the following limiting views of how shopping relates to buying on an e‐commerce site:

- “Since buying is digital, shopping must be digital”.

- “I’ve done my search marketing, we are set to launch”.

- “Like me, my customers don’t like getting email”.

Expanded View of E-Commerce Marketing

In this view, all shopping mechanisms potentially lead to buying over the web. Other digital media can lead to digital buying. Print shopping can lead to digital buying. Personal interactions can lead to digital buying.

Integrated View of Multi-Channel Marketing

Ultimately, each shopping mechanism can support any other buying mechanism. Finding the mix that works for your company is what matters.

Key Questions for E-commerce and Multi-Channel Strategy

- How do my customers shop (not order)?

- How do my customers order?

- How do my customers want to receive communication?

- What ordering methods do my customers require to continue business with me?

Conclusion

- Many distributors experience “Build it and they don’t come.”

- Shifting the focus from tactical to strategic is key to having a mature e-commerce capability.

- Viewing e-commerce as part of a broader multi-vehicle and multi-channel strategy is essential for success.

Survey Respondents

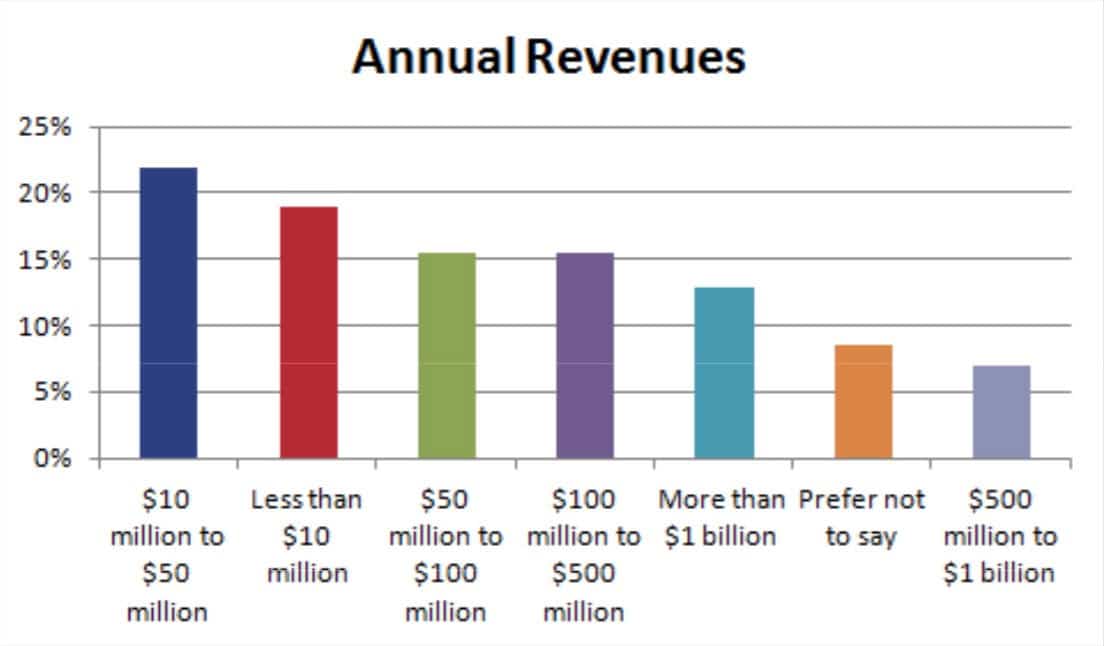

Respondent Annual Revenue

- Nearly 40% are small distributors with less than $50M.

- More than 30 percent are mid‐market with $50 million to $500M.

- 19% are large with more than $500 million revenue. Others did not disclose the revenue range.

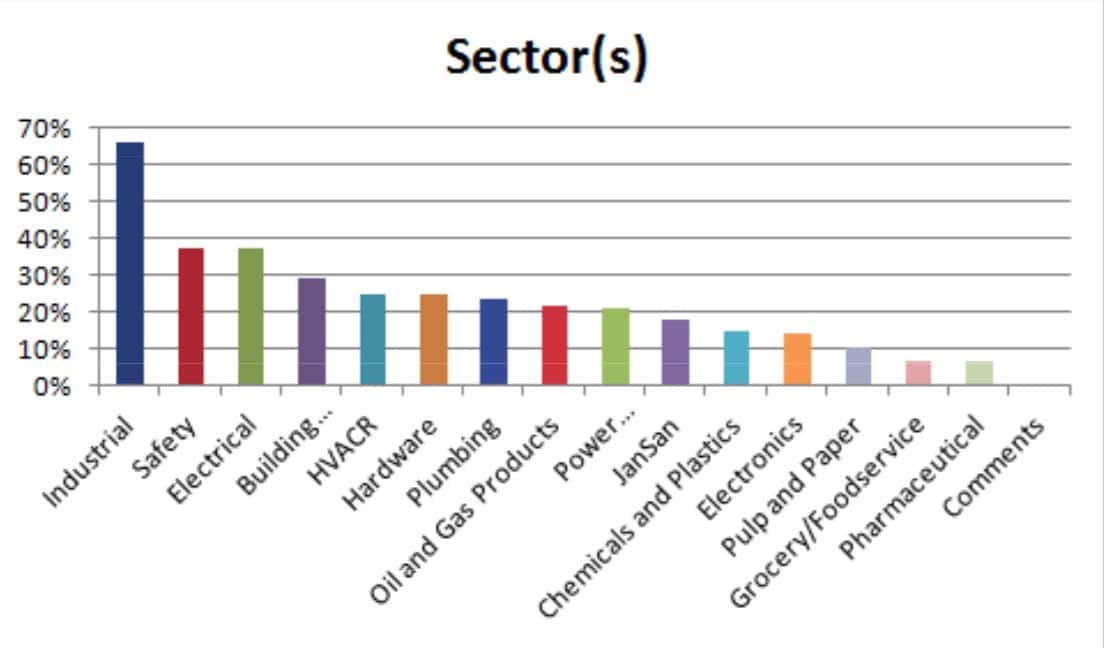

Respondent Business Sectors

- Nearly 70% are industrial.

- One third are safety or electrical.

- About 30% are building materials.

- About 25% are HVACR/plumbing, hardware, plumbing, oil and gas.

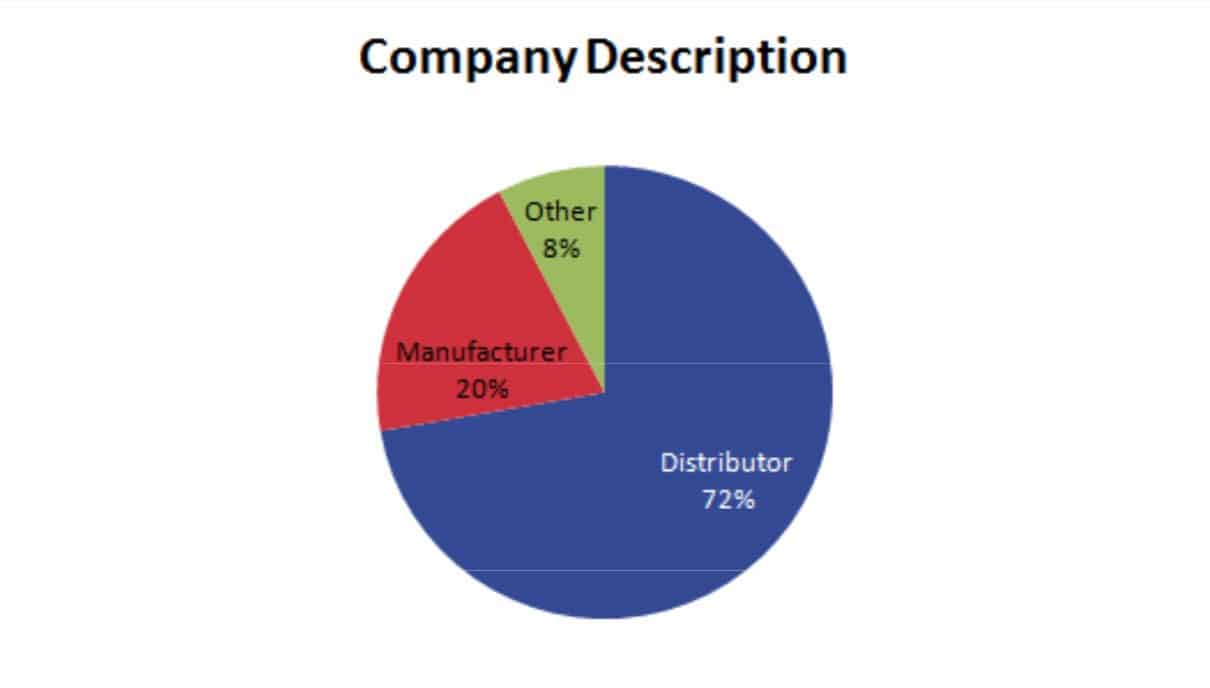

Company Description

- More than 70% distributor.

- 20% manufacturer.

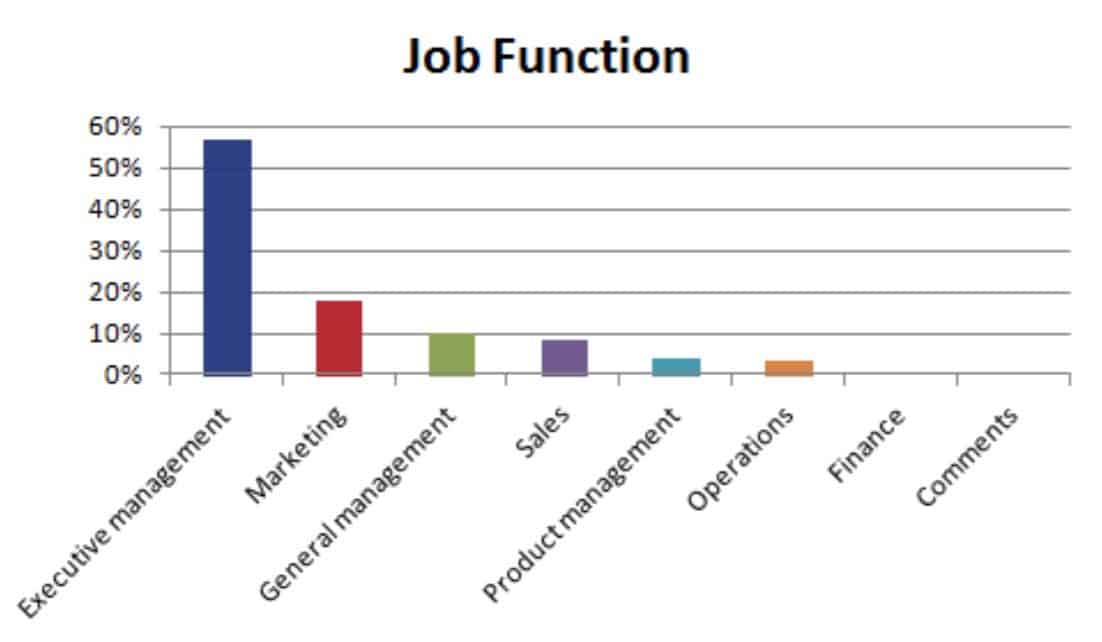

Respondents by Job Function

- Over half in executive management.

- 26% marketing or sales.

Jonathan Bein, Ph.D. is Managing Partner at Distribution Strategy Group. He’s

developed customer-facing analytics approaches for customer segmentation,

customer lifecycle management, positioning and messaging, pricing and channel strategy for distributors that want to align their sales and marketing resources with how their customers want to shop and buy. If you’re ready to drive real ROI, reach out to Jonathan today at

jbein@distributionstrategy.com.