Value is a persistent term in distribution circles. It is highly unlikely to find the latest newsletter edition, trade magazine or blog without the subject of value mentioned.

The problem with value is twofold: it is defined by the customer, and it is intangible. Ergo, the subject and management of it has received little attention. Any substantial investment in “value” or “value add” is difficult to measure a financial return.

Our intention, in this series, is to introduce the subject of Value Management. We argue that a formalization of value is essential to the privately-owned, full-service distribution firm that dominates most durable goods markets. Value can be defined, improved, marketed and delivered in such a way that it improves profitability and competitive resilience. And the timing of Value Management is prescient as the outlook for full-service firms is being severely challenged.

Forecasts for online distribution sales vary by sector; however, there is general agreement that online sales will equal or overtake other transaction methods by the end of the decade. This trend, while seemingly good for the customer, may not be as positive for the full-service, generational distributor.

Online commerce is dependent on the quality of the site, algorithms and artificial intelligence for customer satisfaction; interaction with a qualified inside seller is mostly eliminated. Yet, inside and outside sellers of tenure and training can add tremendous value in recommending substitutions, add-on sales, service selection, troubleshooting, etc.—all services that are difficult to get while shopping online. Unmentioned and under-marketed, however, these seller service advantages are too often forgotten, and the distributor relegates their value add to that of a self-serve customer.

Low-cost/low-service value competitors began to cut into the full-service distributor market share over a decade ago. The watershed event was the rise of Amazon Business, Zoro and other self-serve entities that offer an attractive price and great selection if you know what you want and have a limited number of questions. eCommerce-only models, today, are found in all vertical markets of durable goods distribution and the firms are, by our forecasts, growing at a rate faster than the overall market.

Almost all ecommerce-only models come from outside traditional distribution’s space and only one successful ecommerce entity (that we know of), Zoro, was launched by a traditional distributor parent company (i.e., Grainger). For full-service distributors, to try and price compete with ecommerce competitor, is folly. They are high value-added firms with a higher operating cost.

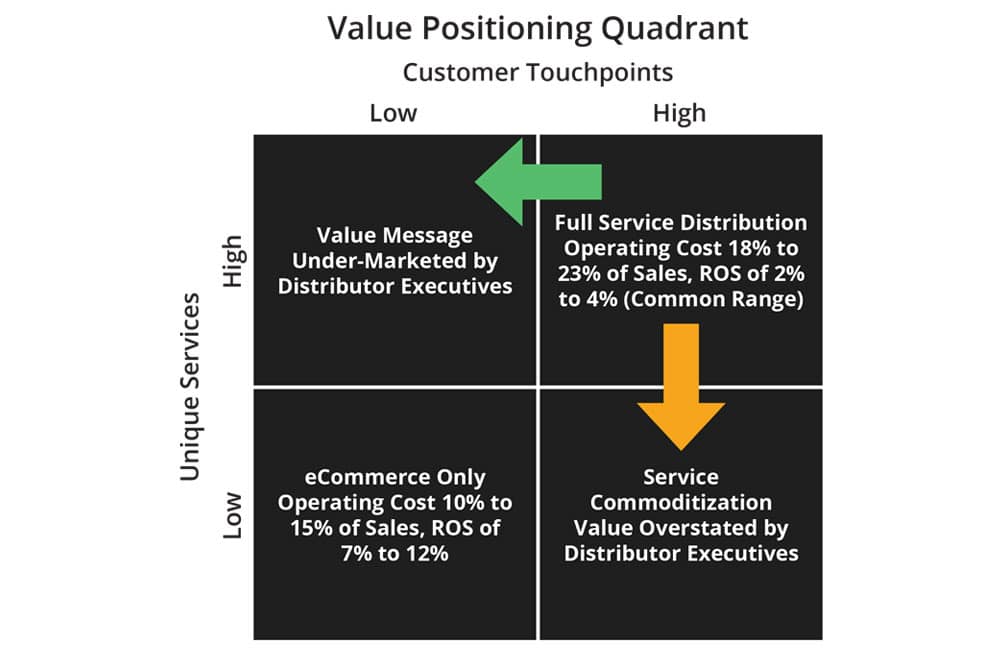

The problem is that if distributors do not make their value visible and tangible, and manage it, the customer forgets about the value difference and migrates to the online-only competitor with a lower operating cost and reduced price. The strategic quandary can be seen in the Value Positioning Quadrant in Exhibit I. In the quadrant are axes of Unique Services (vertical) and Customer Touchpoints (horizontal).

In the southwest quadrant, the ecommerce-only entity has low unique services and low customer touchpoints. The delivered value is a low-cost/low-price service that is very profitable from a Return on Sales viewpoint. Most full-service firms can’t compete in a price war with an ecommerce competitor, at least for very long, as their operating costs are too high.

A well-functioning distributor can be found in the northeast quadrant where there are highly unique services and high customer touch points. More importantly, the customer understands the unique value from both a subject matter and financial standpoint.

The problem is that most distributors fall into the northwest or southeast quadrants where the value message is distorted, misunderstood and therefore under-valued by the customer. In the southeast quadrant unique services are low and customer touchpoints are high. The distributor is adding too much high-touch cost to a basic service offering. In the northwest quadrant, the distributor has valid unique services, but they are undifferentiated and under-marketed. Hence, the customer does not understand the value added and either will not pay for it or demands a price concession akin to a low value-added competitor. In short, most full-service distributors muddle through a misalignment of value while earning low financial returns.

Our assessment of this incongruence is that low-value and low-touch ecommerce-only competitors are financially more successful and taking market share from full-service competitors because distribution executives do not properly define, develop and make tangible unique value offerings. To improve this situation, executives will need to engage new tools and develop new capabilities to enhance their value, make it tangible and capture it for financial gain.

Defining Value

Value in B2B markets is not a construct. The better the value offering is defined and managed, the better the financial performance and competitive strength of the firm. Value in business markets is the monetary worth of technical, economic, service and social benefits derived by the customer from an ongoing relationship.

The first step in defining value is to map the value offerings. These offerings may be product-based or, more-often with distributors, service-based. There are three levels of value-added offerings:

Basic Service: For distributors this includes the common service cycle of ordering, breaking bulk, stocking, taking the customer order, picking, shipping and extending credit. These services are expected to be conducted with minimal error; they are remembered when they are not provided to expectation.

They are, for the most part, rolled into the product price unless provided by an outside service provider such as freight. Basic services should be flow-charted, bottlenecks and service problems reduced. This often involves special programming or software. Without a high level of quality in basic services, creating and launching more value-added services is difficult. Why? In the customer’s logic, if the distributor can’t get the basics right, they will have trouble with the more difficult services.

Augmented Service: These are services that some distributors provide but not others. They can include inventory management services, design services, onsite labor, etc. The distributor may charge outright for these services, and much is dependent on the competitive environment.

Unique Service: Include services that are provided solely by the distributor or by select competitors. Unique services include highly experienced personnel in areas of audits, advisory services, process redesign and other customized offerings. Because of the nature of these services and their cost of provision, they are almost always fee-based. Increasingly, distributors offer light manufacturing services that involve capital investment in plant and/or equipment. Because these investments are substantial, careful attention should be paid to product marketing and pricing.

Distributors cannot simply jump into developing new services, touting them as newly discovered or resort to sloganeering to drive their value in the market. Value management is a methodical, step-by-step process that maps service offerings, determines their value relative to the marketplace and sets an acceptable price.

Value mapping is an exercise that is often left out of attempts to understand and better execute service offerings. The prevailing logic is that the company understands services well enough, but customers just don’t know about them. This is seldom the case. Services have lifecycles and must be continually managed. Like with products, what was once a differentiating service can quickly become obsolete. In one instance, we found a PVF distributor who purchased pipe trucks with a boom that could get the 21-foot pieces of pipe up several stories to the contractor. Initially, the service was in great demand and secured extra business as the contractor did not have to provide the service. Unfortunately, the distributor did not charge for the service and confused its unique value with a commodity product of steel pipe. Competitors, many with deeper pockets, soon purchased their own boom trucks and pushed the original service provider out of their No. 1 position.

Value mapping includes concepts of comparisons of parity and differentiation, segmentation of services, launch and post-launch plans. The exercise and its application will be covered in our next installment.

Scott Benfield is a consultant for B2B Manufacturers and Distributors. He is the author of six books and numerous research projects on B2B channels. He can be reached at benfield.scott@aol.com or (630) 640-5605.