Most distributors keep busy enough just handling incoming calls, emails and, in many cases orders from their website. But how do we know if we are actually winning?

- Are we gaining new customers faster than we are losing them?

- Are we growing business with existing customers or just holding our own?

- Are we leaving business on the table or spending too much time on customers that will not grow?

- Finally, at the end of the day, are we making more money than it costs to keep the business open?

These are the questions every distributor needs to ask every day if they want to thrive.

One of the most effective ways to think about measuring the health of your business is by knowing what kind of customers you are serving and qualifying which customers will help you meet your most important business goals. Usually these goals are around sales volume, growth, margin and profits.

Unknown Unknowns: What Keeps Us from Building Good Customer Profiles

“As we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know.” – Donald Rumsfield

Everyone thinks they know who their best customers are. Certainly, they know the biggest accounts and the ones who have been customers the longest. And they know generally whether they have done well with certain types of businesses. However, they are not always accurate, and distributors are often unaware of some groups of customers that are more profitable, growing their business faster, or have preferences for the profitable products that they can’t get from your competitors.

Often they are customers who genuinely appreciate your unique products and services capabilities. For example, we worked with a large HVAC supplier who knew that most of their business came from building and electrical contractors. But what they did not see was that these customers had flat or declining revenue growth and shrinking margins.

Meanwhile, we uncovered the early stages of “green building” adoption with over 40% aggregate growth and the highest profit margins for the distributor. By using this customer profile information, the distributor was able to capitalize on new growth opportunities even during a major construction-market downturn.

Distribution Strategy Group specializes in helping distributors identify which customers are ideal for your business by understanding what customers value most using our experience, research, quantitative analysis and tools to gain valuable and actionable insights about the industry, competitors and end customers.

Here’s what we have learned along the way and what distributors can do to thrive in an ever-changing and competitive market.

How to Build a Good Customer Profile

Even if most distributors have a good idea about much of their business, nearly every time we work with a distributor we see that there are opportunities they do not fully recognize, and we find ways that their customers are changing over time. Often the best customers yesterday are no longer as strong today, but new opportunities are always being uncovered.

Read more: Value in the Time of COVID-19: What Customers Value Changes with the Times

This is often a result of business cycles as with building and construction, or oil and gas boom-and-bust cycles. It is also common with technology advancements and new industry trends, as with energy-efficient technologies such as LED lighting and green building systems. Or recently with PPE (N95 masks) and some safety products. On the downside, we often see products become commoditized where previously they were the main “cash cows” for the business, likely due to supply chain efficiencies and increasing competition.

When we work with distributor clients, we often begin with some basic analysis of current customers and recent purchase transactions. By combining customer data with other types of information we create a profile for each account, as well as segment profiles for groups of customers that share common firmographic attributes.

For example, using common industry classification data such as SIC or NAICS descriptions, we can identify that certain types of businesses purchase more products than others. Manufacturers are different from construction contractors, and both are different from their end-users.

We may also see that the size of customers can indicate whether we can do more business with them, often in surprising ways. For example, a small specialized plumbing contractor may consistently do more business with us than a larger company that may even purchase more plumbing products overall. At a minimum, we can identify customers that we do the most sales volume with. Depending on the kinds of firmographic information we can collect and by analyzing purchase transactions over enough time, we can identify a set of ideal customers as “sweet spots.” With this customer profile information, we can prioritize and focus our sales and marketing efforts to either find more customers like them or engage them to do more business.

Customer Profile as a Proxy for What Customers Value

Our marketing mantra is: “Start by understanding what customers value.” In tandem with evaluating competitors, value propositions and conducting primary research with end customers, we use the customer profiling process to understand how different segments behave to guide a distributor’s response to the market. We are then able to map out effective strategies and tactics to strengthen the position of the distributor in the minds of prospects and customers, as well as to target the best customers with the strongest offers to grow revenue and profits.

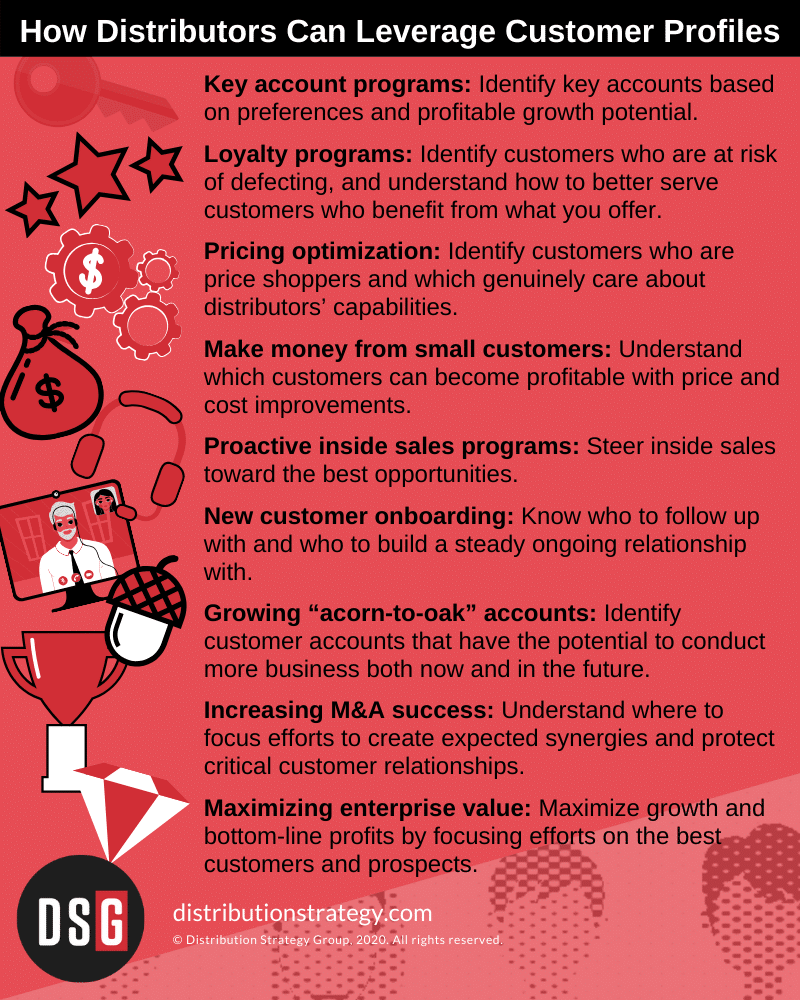

The Distribution Strategy Group’s customer profiling methodology is a straightforward technique we use successfully to get quick hits with proactive sales plus simple and cost-efficient marketing campaigns. However, it is even more powerful as a tool to implement longer term strategic plans such as growth and profitability. This is especially true if the distributor regularly updates the analysis to track progress and discover new market opportunities over time. Some of the ways we have used customer profiling to help distributors define and execute on strategic goals include the following:

Key account programs. Instead of taking accounts for granted because they provide the largest order volume or sales revenue, we use the customer profile to establish a more strategic relationship with the customer, and to identify more key accounts like them based on preferences and profitable growth potential.

Customer loyalty programs. We use the customer profile to identify customers who are at risk of defecting to competitors to recover a relationship, and to understand how to better serve customers who will benefit from what we offer.

Pricing optimization. We use the customer profile process to identify which customers are simply price shopping and which genuinely care about distributors’ capabilities. This allows distributors to be fairly compensated, to avoid leaving money on the table, and to prioritize sales, marketing and customer service efforts to maximize cash flow and profits.

Make money from small customers. Most customers generally lose money for the distributor because they are smaller and less efficient to work with. Not only are most small customers unprofitable, but they eat into the profits generated by the best customers. We have successfully used customer profile information to turn this around by understanding which customers can become profitable when we adjust prices, lower cost to serve, improve sales and marketing effectiveness, and implement other efficiency improvements.

Proactive inside sales programs. When the distributor needs to acquire new customers, re-engage previous customers, and increase sales volume to customers, the customer profile information provides a compass to steer towards the best opportunities. Instead of just “dialing for dollars” or excessive email blasts, we know who to reach out to, and what they are likely to purchase based on what type of customer or prospect they are.

New customer onboarding. When new customers are shopping or purchasing from the distributor, we can use the customer profile information to know which to follow up with and how to build a steady ongoing relationship with.

Growing “acorn-to-oak” accounts. Even more important than bringing on new customers, the best distributors know how to identify customer accounts that have the potential to conduct more business both now and in the future. We use the customer profile and related information to cherry pick segments and individual accounts that we can likely grow into key accounts by understanding how much business potential they have, and which products and services they need most.

Improving M&A integration and success. As more distributors are attempting to grow by acquiring competitors or complementary suppliers, we have seen that most mergers and acquisitions have not met expectations. While this is often considered a failure in operations integration, we have seen that a significant reason for delays in success is actually a failure to understand the newly combined customer set. Customer profiling is an effective way for the distributor or understand precisely where to focus efforts to create the expected synergies and to protect the critical customer relationships.

Maximizing enterprise value. While many smaller distributors are actually “lifestyle businesses” for individual owners and management teams, most distribution companies intend to reap the rewards of selling the business in a not-too-distant future. Whether the timeframe for achieving a worthwhile exit is one to three years, five to 10 years, or longer, the most important aspect of managing the business until then is to maximize growth and bottom-line profits.

Even if the current goal is not a company sale, there are always financing needs for cash flow or expanding warehouse capacity, increasing sales resources or upgrading technology. Leveraging customer profile information effectively has a direct impact on what the distributor is worth as a business. This is because we can use additional performance metrics to augment the customer profile information to demonstrate specifically what the customer base is worth as a key asset of the business.

Customer profile analysis only fails when you don’t take action.

Because many companies suffer from “analysis paralysis,” and a habit of maintaining the status quo, analyzing customer profiles is a simple way to star . At Distribution Strategy Group, we’ve been teaching people how to identify, reach and engage customers more effectively for years – by knowing who your ideal customers are, by offering what customers truly want and need, and by getting you compensated well for what you deliver.

Stay tuned for more from us about how to use economic value and customer analytics as a competitive advantage.

As always, we welcome your feedback. Please feel free to post a comment below or you can email me at rkelley@distributionstrategy.com.

Robert Kelley is Partner with Distribution Strategy Group. He’s had an extensive career as a technology leader with high-growth companies from high-technology startups to large public corporations. Using quantitative analytics models and software applications, Rob now helps distributors optimize pricing, quantify economic value, analyze the competition, and build customer profiles and market segmentation. Reach out to Rob today to take a data-driven approach to your business problems:

rkelley@distributionstrategy.com.